RBI maintains repo rate at 6.5%, revises growth and inflation projections

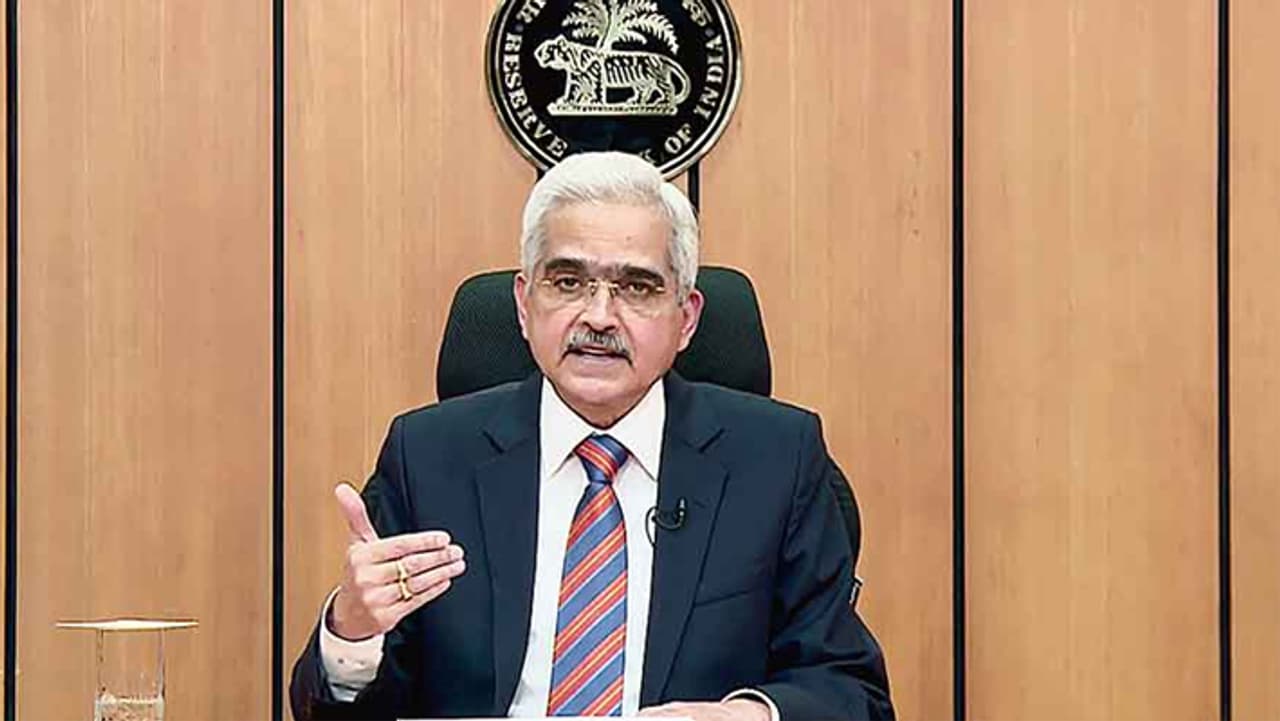

RBI Governor Shaktikanta Das said that the decision was made by a 4:2 majority vote during the committee's final meeting of the year.

The Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) on Friday (December 6) announced that the repo rate will remain unchanged at 6.5%. RBI Governor Shaktikanta Das said that the decision was made by a 4:2 majority vote during the committee's final meeting of the year.

Key rates unchanged

The Standing Deposit Facility (SDF) rate remains at 6.25%, while the Marginal Standing Facility (MSF) and Bank Rate are steady at 6.75%. Governor Das stressed that these measures align with the central bank's monetary policy stance aimed at controlling inflation and maintaining economic stability.

GDP growth forecast revised

India's GDP growth projection for the current fiscal year has been revised downward to 6.6%, compared to the earlier estimate of 7.2%. This adjustment follows a GDP growth of 5.4% in the second quarter (July-September), the slowest in seven quarters.

"Growth in real GDP in the second quarter of this year at 5.4% turned out to be much lower than anticipated," Das said. He attributed the decline to factors such as a slowdown in industrial growth, contraction in mining activities, and decreased electricity demand.

Signs of recovery

Despite the slowdown, Das noted signs of recovery in the economy. "High-frequency indicators suggest that the slowdown in domestic economic activity bottomed out in the second quarter and has since recovered, aided by strong festive demand and a pickup in rural activities," he said.

Inflation and CRR adjustments

The central bank raised its retail inflation forecast for FY'25 to 4.8%, up from 4.5%. Meanwhile, the Cash Reserve Ratio (CRR) has been reduced by 50 basis points to 4%. This measure aims to provide additional liquidity to support economic activity.

Future outlook

This was the last MPC meeting for 2024, following the October session. The next meeting is scheduled for February 2025. According to a report by HDFC Bank, a hike in the repo rate could be on the cards during the next session, depending on inflation trends and economic recovery.

Stay updated with the Breaking News Today and Latest News from across India and around the world. Get real-time updates, in-depth analysis, and comprehensive coverage of India News, World News, Indian Defence News, Kerala News, and Karnataka News. From politics to current affairs, follow every major story as it unfolds. Get real-time updates from IMDon major cities weather forecasts, including Rain alerts, Cyclonewarnings, and temperature trends. Download the Asianet News Official App from the Android Play Store and iPhone App Store for accurate and timely news updates anytime, anywhere.