The consumer price inflation (CPI) projection has been reduced from 6.7 per cent to 6.5 per cent for the current fiscal year. While inflation is predicted to drop in 2023-24, it is still expected to exceed the 4 per cent target.

The Reserve Bank of India slowed the pace of the interest-rate hikes for the second time in a row on Wednesday, February 8, 2023, raising borrowing costs by 25 basis points but hinting more to come as core inflation remained high.

The RBI's Monetary Policy Committee of six members voted 4-2 to raise the benchmark repurchase or repo rate to 6.50 per cent while maintaining its earlier adopted policy of reducing support. This increase was the sixth consecutive increase in interest rates since May last year, bringing the total hike to 250 basis points.

In December 2022, the RBI hiked interest rates by 35 basis points. 40 basis points raised rates in May and by 50bps in June, August, and September.

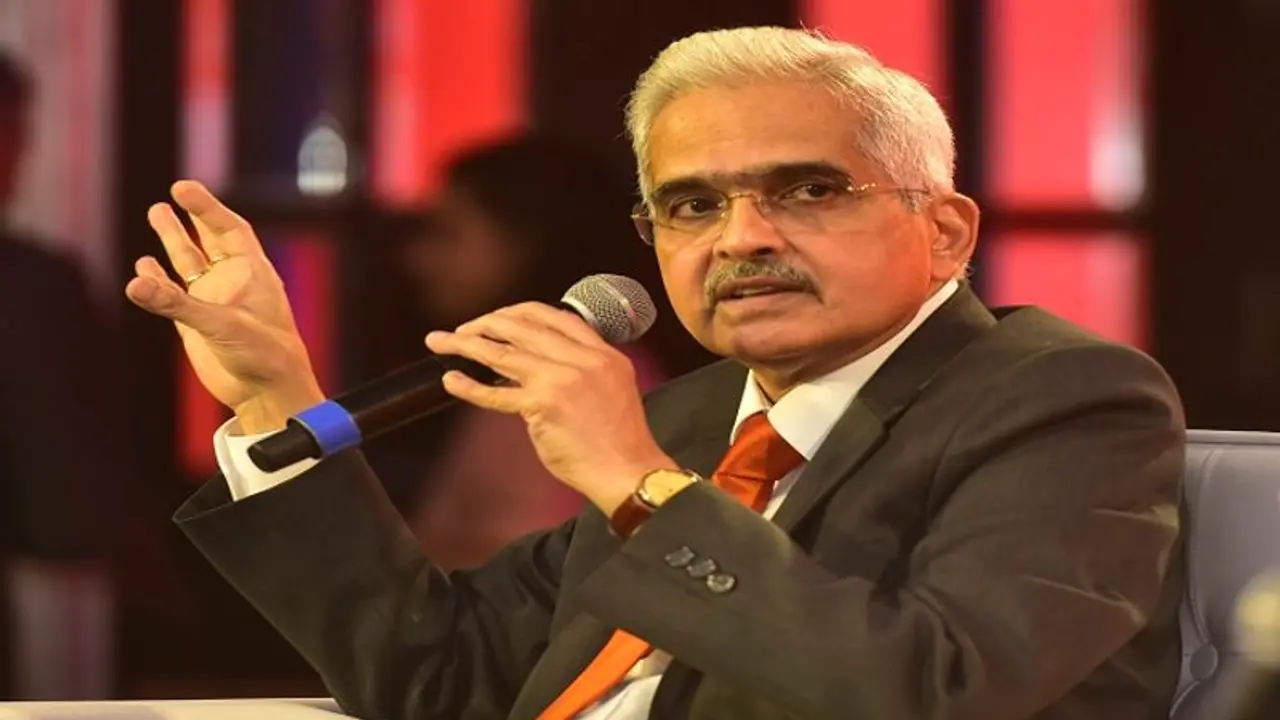

While announcing the monetary committee's decision, RBI's Governor Shaktikanta Das said, "The stickiness of core or underlying inflation is cause for concern. We need to see a decisive moderation in inflation. We must maintain our commitment to lowering CPI headline inflation." Das added, "Adjusted for inflation, the policy rate still trails its pre-pandemic levels, and liquidity remained in surplus."

The consumer price inflation (CPI) projection has been reduced from 6.7 per cent to 6.5 per cent for the current fiscal year. While inflation is predicted to drop in 2023-24, it is still expected to exceed the 4 per cent target.

Retail inflation dropped to 5.72 per cent in December from 5.88 per cent the previous month, plunging below the Reserve Bank of India's upper tolerance band of 2-6 per cent for the second month, albeit core inflation, which includes more volatile food and fuel prices, remained at 6.1 per cent.

"Moving ahead, the food inflation outlook would benefit from an anticipated bumper rabi harvest driven by wheat and oilseeds," said Das.

The Bank forecasted GDP growth of 6.4 per cent in the fiscal year beginning April 1 (2023-24), down from 7 per cent this year, with Das saying that the Indian economy remained resilient in the face of significant uncertainties in global commodity prices.

"The global economic outlook is not as bleak as it was a few months ago. Growth prospects in major economies have improved, while inflation has begun to fall, albeit it remains considerably above target in most of them. The situation continues to be fluid and uncertain," he said. Additionally, with the relaxation of COVID-19-related restrictions in some regions of the world, commodity prices may remain firm.

On Wednesday, among the changes announced was permitting lending and borrowing of government securities or G-secs to 'allow investors to deploy their idle assets, increase portfolio returns and facilitate wider participation.'

"This action will also count depth and liquidity to the G-sec market; help in efficient price discovery; and contribute to the seamless completion market borrowing programme of the centre and states," Das added.

The RBI also restored the Government Securities market hours to their pre-pandemic levels of 9:00 am to 5:00 pm.

According to Das, the rupee has remained one of the least volatile Asian currencies. The Indian rupee's devaluation and volatility during the present phase of numerous shocks are significantly lower than during the global financial crisis and the taper tantrum.

He believes that the movements of the rupee indicate the strength of the Indian economy. The current account deficit (CAD), which amounted to 3.3 per cent in the first half of 2022-23, is predicted to decline in the second half and 'remain eminently manageable and within the bounds of viability.'

Furthermore, Das said that draught rules for the imposition of penal interest on advances would be prepared for comments.

With UPI growing increasingly popular for retail digital payments in India, the RBI has proposed allowing all inbound travellers to utilise UPI for merchant payments (P2M) while in the country. "This service will be given to G-20 travellers arriving at specified international airports," he continued.

Also, the RBI launched a 12-city pilot project for QR Code-based Coin Vending Machines (QCVM). Instead of physically tendering banknotes, these vending machines will deliver coins in exchange for a debit to the customer's account via UPI. This will make coins more easily accessible.

(With inputs from PTI)

Also read: 'G20 travellers can use UPI for payments at select airports': RBI Governor Shaktikanta Das