The recent cut in excise duty and value added tax by states will augment purchasing power of people, the Governor said.

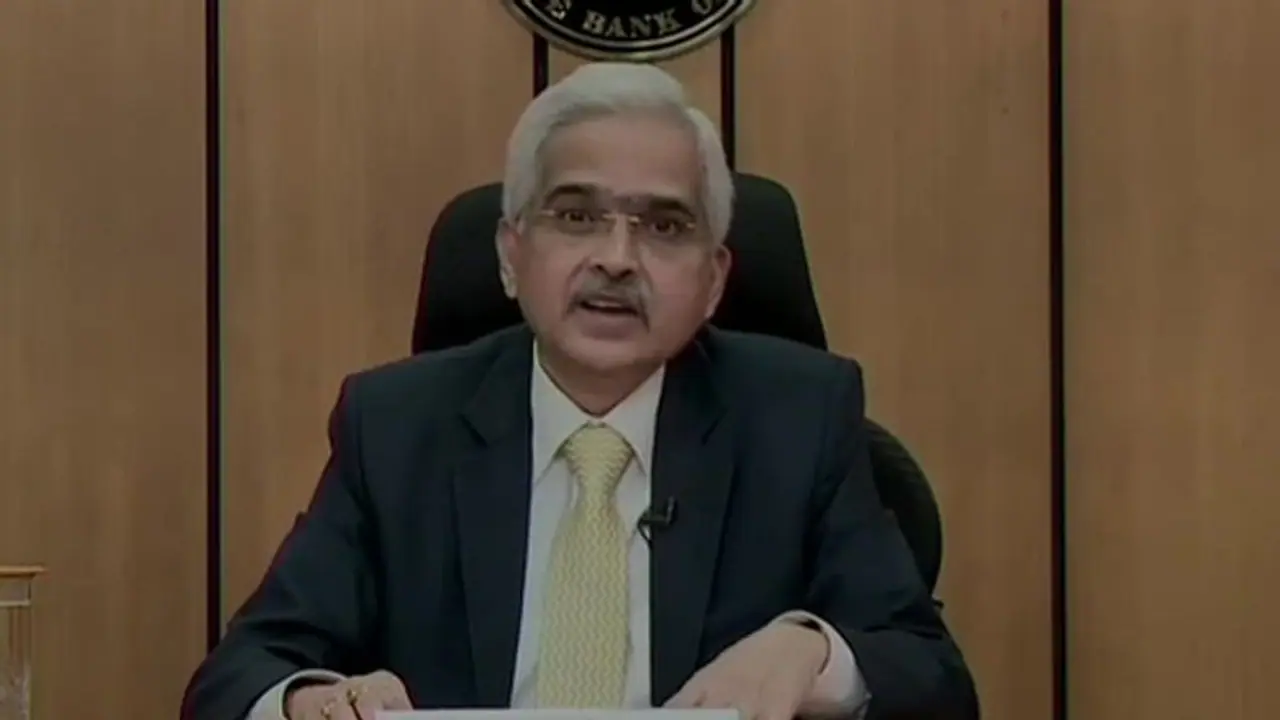

The Reserve Bank of India (RBI) Governor Shaktikanta Das on Tuesday said that numerous macro indicators suggest that the economic recovery is now taking hold after the beating it has taken during the pandemic, but private capital investment has to resume for growth to be sustainable and reach its potential.

“I firmly believe that India has the potential to grow at a reasonably high pace in the post-pandemic scenario,” Shaktikanta Das said. He added, “Numerous high-frequency indicators suggest that economic recovery is now taking hold... While the economy is picking up, it is yet to cover a lot of ground before it gets broad-based and well-entrenched.”

He said that there are signs that consumption demand is making a strong comeback. The recent cut in excise duty and value added tax by states will augment purchasing power of people, the Governor said. “This would encourage firms to expand capacity and boost employment and investment amidst congenial financial conditions,” Das said while speaking at the SBI Banking and Economics Conclave on Tuesday.

Addressing a banking function -- which he said is his first since the pandemic began in March 2020, Das mentioned that with a scale of vaccination which is among the highest in the world, India is poised to lead the fight against Covid-19. “India’s remarkable progress on vaccines is a shining example of scientific capabilities,” the RBI governor said. He added that contact-intensive services still need to lose momentum.

Despite many economists revising down their growth forecasts between 8.5 and 10 per cent for the current fiscal, the central bank has not changed its forecast of 9.5 per cent for the year so far, Das said.

Speaking on the banking sector, he urged the banks to be investment-ready when the investment cycle picks up, which the RBI thinks is likely to begin from the next financial year. Das said, adding there is an important role for the public sector. Current trend of investment-led recovery can get a further boost if public expenditure plays a major role, Das said.