The RBI has proposed to permit all inbound travellers to India to use UPI for their merchant payments (P2M) while they are in the country. To begin with, this facility will be extended to travellers from G-20 countries arriving at select international airports.

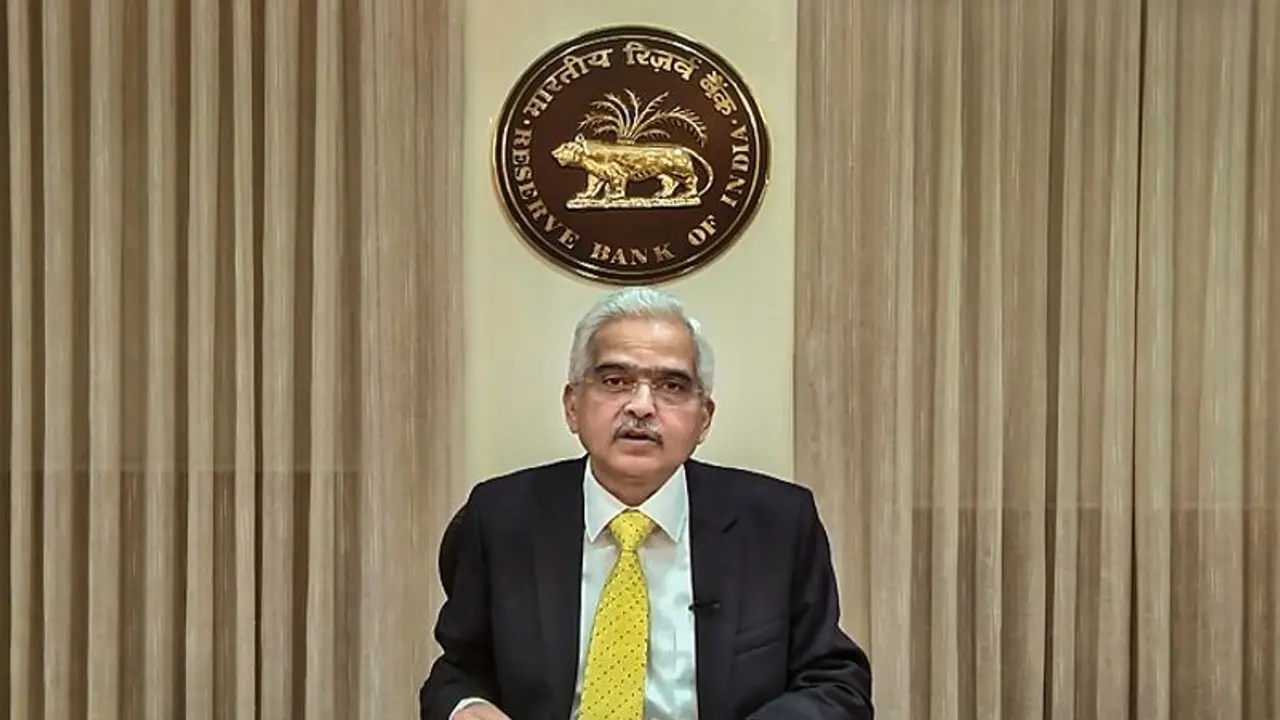

The Reserve Bank of India (RBI) Governor Shaktikanta Das on Wednesday (February 8) announced the Monetary Policy statement and said that the RBI has proposed to extend the UPI facility to inbound travellers for merchant payments; initially to travellers from G20 countries.

It can be seen that payments through UPI have become hugely popular for retail digital payments in India. The RBI now proposed to permit all inbound travellers to India to use UPI for their merchant payments (P2M) while they are in the country. To begin with, this facility will be extended to travellers from G-20 countries arriving at select international airports.

In his address, Das said, "It's now proposed to permit all inbound travellers to use UPI payments for their merchant payments while they are in the country. To begin with, this facility will be extended to travellers from G20 countries arriving at select international airports."

Meanwhile, the RBI has also projected inflation to remain above the 4 percent target and said that inflation is expected to average at 5.6 percent in Q4 of 2023-24. This is the first MPC meeting to be held after Union Finance Minister Nirmala Sitharaman presented the Budget 2023 in the Parliament.

"Unprecedented events of the last three years have put to test monetary policy across the world. Emerging market economies are facing sharp tradeoffs between supporting economic activity and controlling inflation while preserving policy credibility," the RBI Governor said.

For the financial year 2023, the RBI Governor said that the Gross Domestic Product (GDP) growth estimate has increased to 7 percent from 6.8 percent.

"Inflation is projected at 6.5% for the current financial year 2022-23. On the assumption of a normal monsoon, CPI inflation is projected at 5.3% for 2023-24," he added.