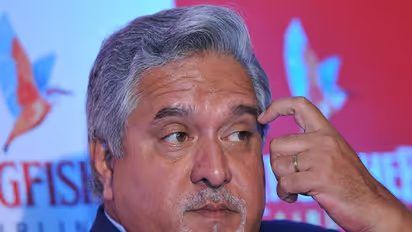

How will the banks recover Rs 9000 crore from Mallya?

Synopsis

The Debt Recovery Tribunal gave Mallya's lenders the green light to recover their funds. The total on-paper value of the seized assets of Mallya is Rs 8000 crore. Whether the 17 banks will be able to recover anything close to that amount is yet to be seen.

The Debt Recovery Tribunal ordered the SBI-led consortium of banks to start the process of recovering Rs 6,203 crore, at annual interest rate of 11.5 percent, from embattled tycoon Vijay Mallya and his companies in the Kingfisher Airlines case.

"I hereby ask the bankers to start the process of recovery of Rs 6,203 crore at the interest rate of 11.5 per cent per annum from Mallya and his companies including UBHL, Kingfisher Finvest and Kingfisher Airlines," DRT Presiding Officer K Sreenivasan said in his order.

United Breweries (Holdings) Ltd (UBHL) is promoted by Mallya, of which he was made the Principal Officer last September in the absence of a Managing Director, while Kingfisher Finvest is a holding company.

The 'recovery' is expected to occur through the sales of the various properties attached to Vijay Mallya that the CBI and other agencies seized over the past year or so. So here is what they have -

1. Mandwa farm house, Alibaugh (Rs 25 crore)

2. Kingfisher Tower flats, Bengaluru (Rs 565 crore)

3. HDFC deposits (Rs 10 crore)

4. USL, UBHL and Macdowell Holding shares (Rs 3635 crore)

5. An apartment in Mumbai and home in Goa (Rs 120 crore)

And this is hardly an exhaustive list. For example, among his assets, seized around India, include items like a 27-acre coffee estate in Coorg, the actual planes and other things that Kingfisher has, etc. And this is what the authorities could legitimately find and seize. The fancy apartments in Trump Tower in the United States, for example, are worth millions but beyond the reach of the Indian government currently.

Incidentally, Vijay Mallya was paid 75 million dollars by British liquor giant Diageo as part of a severance package for quitting Diageo-owned United Spirits (USL) as its Chairman under a 'sweetheart deal. While that money was ordered halted, it was reported that 40 million dollars had already been transferred out by the time the freeze order came in.

Either way, Indians should not get too enthusiastic about the news. Just because the banks have the 'green signal' does not mean they are going to recover Rs 9000 crore. For example, the re-auction of Mallya's Goa property, Kingfisher Villa, turned out to be a damp squib despite a reduction in reserve price by 5 percent to Rs 81 crore by lenders.

This has been the story time and time again. It would seem while Mallya has dumped India, India cannot offload Mallya's legacy.