Rigetti Computing Stock Leaps On New Flagship Quantum Computer Launch: Retail Celebrates ‘Santa Claus’ Rally

Synopsis

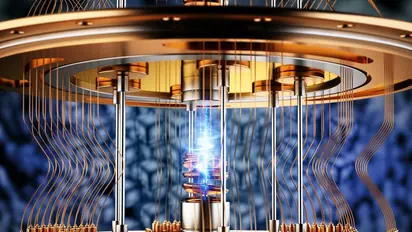

Rigetti emphasized the computer's dramatically reduced error rates and advanced cooling technology, designed to improve quantum computation reliability.

Rigetti Computing's stock surged 30% in the morning but settled at a 20% increase by midday after the company unveiled its 84-qubit Ankaa-3 quantum computer, which promises to accelerate algorithmic research.

The stock was among the top 10 trending tickers on Stocktwits, though it is currently trading about 10% below its 52-week high of $12.75, achieved just last week.

“We are constructing computing systems with capabilities that have not been seen before,” said chief technical officer David Rivas, in a statement.

The 84-qubit Ankaa-3 system processes information much faster than traditional systems, with a 99.5% accuracy in its quantum movements, making it more precise than competitors, according to the company.

Rigetti also emphasized the computer's dramatically reduced error rates and advanced cooling technology, designed to improve quantum computation reliability.

The system, accessible via cloud platforms like Amazon Web Services and Microsoft Azure, broadens Rigetti's reach to enterprise customers.

This launch is part of Rigetti's broader plan to create increasingly powerful quantum computers, with future systems surpassing 100 qubits.

The company also plans to leverage its $225 million cash reserve to fund ongoing innovations, according to the company’s statement.

Retail sentiment on Stocktwits shifted from 'bearish' to 'bullish' within a day, with message volumes rising from 'low' to 'normal.'

Users debated the stock's long-term potential, with some speculating that the stock may go ‘to the moon.’

However, others remained more cautious given the stock’s recent volatility.

Analysts note that Rigetti holds a first-mover advantage in quantum computing, positioning it to play a significant role in fields like cryptography, AI, and advanced material science.

However, they also point out that quantum computing remains a high-risk sector, citing Rigetti’s ability to deliver on its technological promises and scale its systems commercially as critical for sustained growth.

Rigetti's future success will depend on its ability to meet technological promises and scale its systems commercially.

Rigetti's stock, which recently surpassed a $2 billion market capitalization, has gained over 1,000% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.