Exide Industries Shares Pare Early Gains But SEBI RA Sees 18% Potential Upside

Synopsis

Exide announced an additional investment of ₹80 crore in its wholly owned subsidiary, Exide Energy Solutions (EESL), through a rights issue

Shares of Exide Industries reversed early-session gains to trade 0.7% lower at ₹390.50 as broader markets experienced sharp declines in the afternoon.

Post-market hours on Thursday, Exide announced an additional investment of ₹80 crore in its wholly owned subsidiary, Exide Energy Solutions (EESL), through a rights issue. This brings the total investment in EESL to ₹3,882.23 crore.

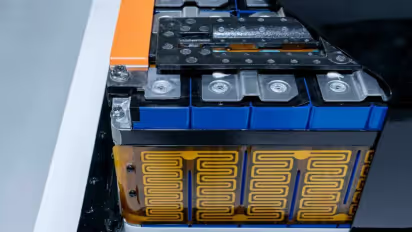

EESL manufactures and sells lithium-ion battery cells, modules and packs for the electric vehicle market and stationary applications.

Analyst's Take

Technically, the stock remains in a consolidation phase, noted SEBI-registered analyst Ashok Kumar Aggarwal.

https://stocktwits.com/equitycharcha/message/630086908

For investors with a medium-term outlook, analysts recommend a buying range of ₹393.50 - ₹395.50, with a stop-loss at ₹371 on a closing basis.

Exide’s price targets are pegged at ₹442 – ₹460, reflecting a moderate upside potential, the analyst said.

The company’s dual strategy of strengthening its core business while investing aggressively in new-age energy solutions makes it a stock to watch closely in the evolving energy and mobility landscape, he added.

The company is making significant strides in lithium-ion technology for electric mobility and stationary power applications, two areas expected to see strong growth in the coming years, Aggarwal said.

From a financial perspective, Exide is currently trading at a price-to-earnings (PE) ratio of 39.7, with a return on capital employed (ROCE) of 8.65 and return on equity (ROE) of 5.74.

While these metrics may not appear highly attractive, the company’s market leadership and diversification into new energy solutions add a layer of long-term potential, he said.

Stock Watch

Retail sentiment on Stocktwits shifted to ‘neutral’ from ‘bullish’ a day earlier.

Year-to-date, the stock has shed 6.4%.

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.