China Mulls Up To $70 Billion Chip Incentives Amid Growing US Rivalry: Report

Synopsis

The Chinese government is considering a package of subsidies and other incentives to boost domestic capabilities.

- The proposals under consideration could range from 200 billion yuan ($28 billion) to 500 billion yuan ($70 billion), reported Bloomberg.

- While the details of the plan are yet to be finalized, the incentives will be in addition to all other existing financial support.

- The push comes as U.S. investors grow increasingly concerned over high AI valuations.

China is reportedly considering incentive packages of up to $70 billion for chipmakers to boost its domestic industry amid its intensifying rivalry with the U.S. in the artificial intelligence race.

According to a Bloomberg report, the country’s officials are considering a package of subsidies and other financial assistance that could range from 200 billion yuan ($28 billion) to 500 billion yuan ($70 billion), the report said.

While final details, including exact amounts and companies likely to receive them are still being debated, the new plan will be in addition to and function separately from already-existing plans like the $50 billion Big Fund III equity-investment vehicle, Bloomberg reported.

The Chip War

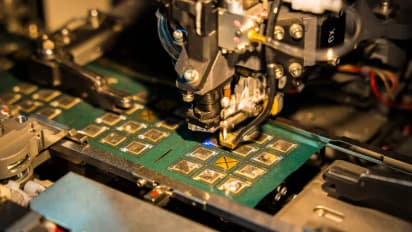

The battle over advanced semiconductor chips for AI has become a key point of rivalry between the U.S. and China as both countries race to outdo each other. Beijing’s push is an indicator to reduce its reliance on non-domestic chipmakers such as Nvidia Corp. ().

President Xi Jinping is seeking to ramp up China’s domestic semiconductor capabilities following multiple export bans from the U.S. that have left the country on uncertain terrain. Although Trump recently announced that he would allow the export of Nvidia’s H200 chips, an older version compared to its latest Blackwell chips, to China under certain conditions, Chinese officials are allegedly discussing if this should be permitted.

Meanwhile, Trump stated on his Truth Social account that the U.S. is leading in the AI race, pushing back on a report from The Wall Street Journal about China’s cheap electricity as a competitive advantage.

How Does The Market Feel?

As the two governments push AI growth heavily, U.S. markets are concerned about high AI valuations and aggressive capex plans.

On Wednesday, Oracle () shares plunged over 11% as investors grew concerned following the company’s revelation of high debt and whopping 438% growth in remaining performance obligations (RPO) for AI projects. The announcement triggered a sell-off in related AI stocks including Nvidia and Advanced Micro Devices ().

The companies’ shares continued to drop further after comments from Broadcom’s () CEO Hock Tan revealed a $73 billion backlog of AI product orders for the company. The Nasdaq 100 index as well as the Dow Jones U.S. Technology Index closed lower on Thursday.

NVDA shares closed 1.55% lower on Thursday at market close while ORCL shares declined 10.8%.

On Stocktwits, retail sentiment for NVDA stock was in the ‘neutral’ territory, while for ORCL shares, it was in the ‘extremely bullish’ territory.

1 Chinese yuan = $0.14

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.