Sensex surges near 70,000 as Nifty hits historic 21,000 after RBI's policy decision

Synopsis

The Monetary Policy Committee (MPC) unanimously decided to keep the rates unchanged, while a majority of five out of six members supported retaining the current policy stance focused on the "withdrawal of accommodation."

The Reserve Bank of India (RBI) on Friday (December 8) maintained the status quo on the repo rate, holding it steady at 6.50% following the conclusion of its three-day monetary policy meeting. This decision marks the fifth consecutive time that the RBI has refrained from making adjustments to policy rates.

Moments before the RBI's policy announcement, the Nifty 50 index soared to an unprecedented high, reaching the 21,000-point milestone for the first time. Post the announcement, the index showcased a 0.4% increase, standing at 20,989.05 points. Similarly, the Sensex achieved an all-time peak of 69,888.33 points before the policy declaration and continued its positive trajectory, maintaining a high at 69,779.80 points.

RBI MPC Meeting: Repo rate remains unchanged at 6.5%

The Monetary Policy Committee (MPC) unanimously decided to keep the rates unchanged, while a majority of five out of six members supported retaining the current policy stance focused on the "withdrawal of accommodation." This expected monetary policy action set the stage for a bullish trend on Dalal Street, with both the Nifty 50 and the 30-stock Sensex demonstrating remarkable surges.

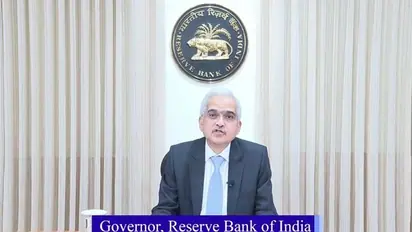

Governor Shaktikanta Das highlighted favorable economic indicators, citing the easing of all Consumer Price Index (CPI) components in October and widespread alleviation in core inflation. The domestic economic activity remained robust, culminating in the MPC's decision to uphold the interest rates while vigilantly monitoring unfolding developments and potential policy measures.

The economy witnessed buoyant government-led investment activities, along with heightened capacity utilization in the manufacturing sector. Moreover, festive-driven household consumption significantly contributed to the economic momentum. The unexpected surge of 7.6% in the Gross Domestic Product (GDP) during the September quarter led the RBI to revise its FY24 projection to 7.0% from the earlier estimate of 6.5%.

KCR may require surgery after fall at his residence; doctors evaluating his condition

This monetary policy stance underscores the RBI's commitment to maintaining economic stability while navigating evolving economic landscapes. The decision to keep rates unchanged mirrors the cautious yet optimistic approach to sustaining growth and addressing potential challenges.

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.