RBI keeps repo rate unchanged at 6.5 pc for ninth straight time

Synopsis

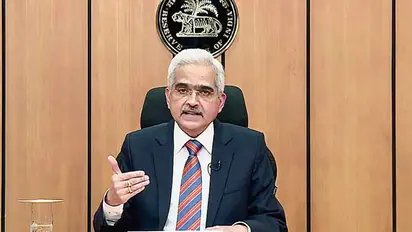

On Thursday, RBI Governor Shaktikanta Das announced that the MPC has decided by a 4:2 majority to maintain the policy repo rate at 6.5%. Consequently, the standing deposit facility (SDF) rate remains at 6.25%, and the marginal standing facility (MSF) rate and the bank rate are at 6.75%.

The Reserve Bank of India (RBI) on Thursday (August 8) decided to keep the repo rate unchanged at 6.5%, ensuring no immediate impact on loan EMIs. The Monetary Policy Committee (MPC) is aiming to guide inflation towards the target while supporting economic growth.

On Thursday, RBI Governor Shaktikanta Das announced that the MPC has decided by a 4:2 majority to maintain the policy repo rate at 6.5%. Consequently, the standing deposit facility (SDF) rate remains at 6.25%, and the marginal standing facility (MSF) rate and the bank rate are at 6.75%.

Delhi Police ramp up security with posters of wanted terrorists ahead of Independence Day 2024

"The decision to keep the policy repo rate unchanged was made to ensure stability in the economy. The focus remains on guiding inflation towards the target while supporting growth," Governor Das said.

The current MPC, comprising three central bank officials and three external members, is set for significant changes this year. The terms of the three external members will conclude on October 6, and their terms cannot be renewed. The MPC is reconstituted every four years, with the government appointing new external members.

The committee includes RBI Governor Shaktikanta Das, whose term ends in early December, Deputy Governor Michael Patra, with a contract until early January, and Executive Director Rajiv Ranjan. The external members are Shashanka Bhide, Ashima Goyal, and Jayanth R Varma.

Weather alert: IMD predicts light showers in Delhi, Noida; Heavy rain in THESE regions

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.