Unchanged trajectory: RBI holds Repo Rate steady at 6.50% for sixth consecutive time

Synopsis

In the previous MPC meeting on December 8, the RBI chose to keep key rates unchanged for the fifth consecutive time. The committee, consisting of three RBI members and three external members, unanimously decided to retain the benchmark repurchase rate at 6.5 percent.

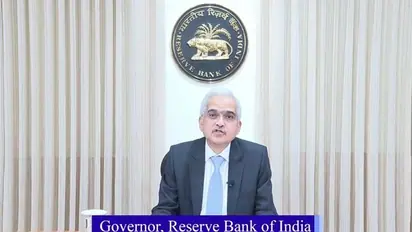

In a unanimous decision, RBI Governor Shaktikanta Das on Thursday (February 8) announced that the repo rate would remain unchanged at 6.5%, maintaining the stance of "withdrawal of accommodation."

In 2023, the RBI maintained the repo rate at 6.5 percent, with the last adjustment in February 2023 from 6.25 percent, aiming to tackle inflation primarily fueled by global factors. Despite a decline from its peak of 7.44 percent in July 2023, retail inflation still stands at 5.69 percent as of December 2023, though within the Reserve Bank's comfort zone of 4-6 percent.

Explained: Congress Black Paper Vs BJP's White Paper: How different are they?

"The MPC decided by a majority of 5 out of 6 members to remain focused on withdrawal of accommodation to ensure the inflation progressively aligns with the target while supporting growth," Governor Das said.

"On one hand, the odds of soft landing have increased with Inflation moving closer to the target and growth holding up better than expected in major advanced and emerging market economies," Governor Das said.

In the previous Monetary Policy Committee (MPC) meeting on December 8, RBI chose to keep key rates unchanged for the fifth consecutive time. The committee, consisting of three RBI members and three external members, unanimously decided to retain the benchmark repurchase rate at 6.5 percent.

Explained: What is PETA's beef with animal-themed merry-go-rounds?

A majority of panel members advocated for maintaining the policy stance at "withdrawal of accommodation," suggesting that rates might stay elevated for an extended period. Governor Das revised the economic growth forecast to 7 percent from 6.5 percent, citing positive indicators such as an expanding manufacturing PMI and robust growth in eight core industries.

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.