In its December monetary policy review, the central bank had raised the key benchmark interest rate by 35 basis points (bps). Since May last year, the Reserve Bank has increased the short-term lending rate by 225 basis points to contain inflation.

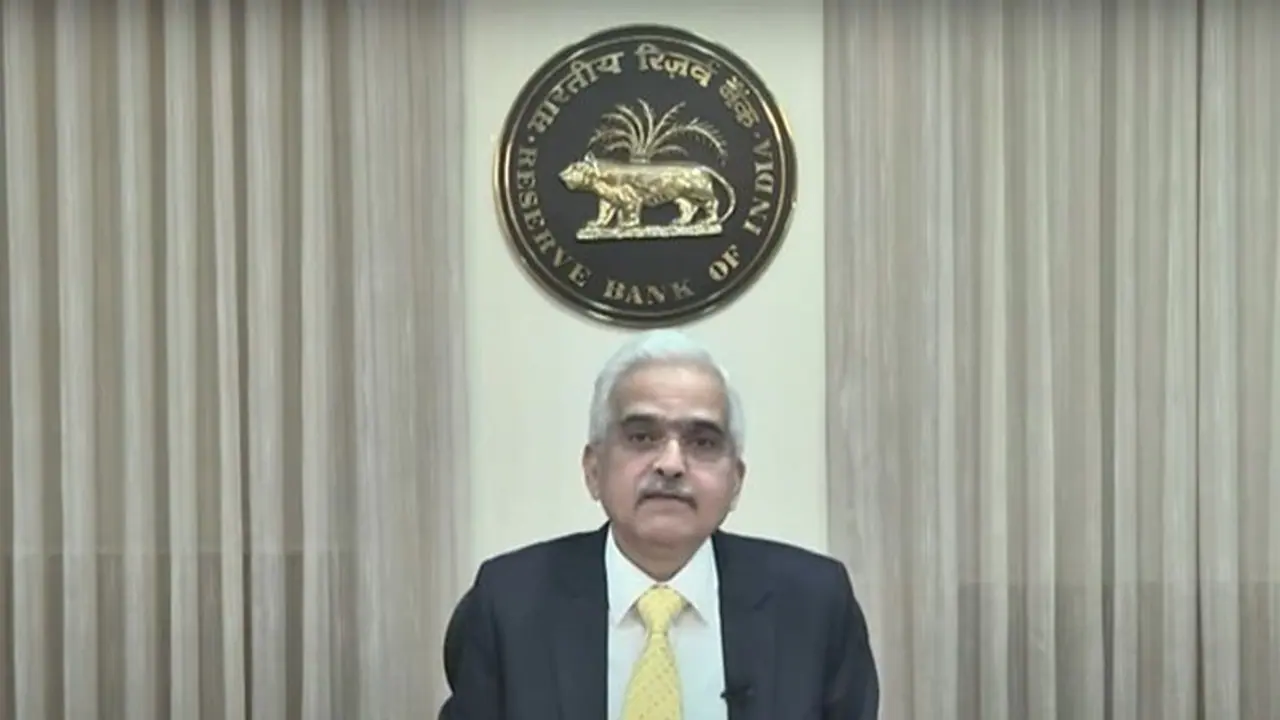

The Reserve Bank of India (RBI) Governor Shaktikanta Das on Wednesday (February 8) announced the Monetary Policy statement. The RBI Governor announced that the monetary policy committee (MPC) has hiked the repo rate by 25 basis points (bps) to 6.50 percent and also withdrew its accommodative stance to tackle inflation.

The RBI has also projected inflation to remain above the 4 percent target and said that inflation is expected to average at 5.6 percent in Q4 of 2023-24. This is the first MPC meeting to be held after Union Finance Minister Nirmala Sitharaman presented the Budget 2023 in the Parliament.

Also read: Delhi liquor policy case: CBI arrests Hyderabad CA, former aide of CM KCR's daughter

In his address, the RBI governor said, "Unprecedented events of the last three years have put to test monetary policy across the world. Emerging market economies are facing sharp tradeoffs between supporting economic activity and controlling inflation while preserving policy credibility."

"The global economic outlook doesn't look as grim now as it did a few months ago, growth prospects in major economies have improved while inflation is on a descent though inflation still remains well-above the target in major economies," the RBI Governor said.

For the financial year 2023, the RBI Governor said that the Gross Domestic Product (GDP) growth estimate has increased to 7 percent from 6.8 percent.

Also read: Aero India 2023 to impact flight operations at Bengaluru airport from today; check details

"Inflation is projected at 6.5% for the current financial year 2022-23. On the assumption of a normal monsoon, CPI inflation is projected at 5.3% for 2023-24," the RBI Governor said.

The RBI Governor also said that Rupee has remained one of the least volatile currencies among its Asian peers and continues to be so. He further said that volatility of rupee during current phase of shocks is far lower than seen in global fin crisis, taper tantrum before.