Pakistan mulling new loan from China to repay bilateral debt; asks Beijing to rollover $6.3 billion debt

Synopsis

Islamabad is looking for a minimum of $6.3 billion to $7.2 billion rollover from China and some sort of fresh lending. Citing sources, the paper said that this time the government was seeking rollover of the $3 billion safe deposit for more than a year -- ideally for up to five years.

In order to try and arrange $34 billion in the current fiscal year to meet its debt and external trade-related obligations, Pakistan has requested China to rollover its $6.3 billion debt, which will mature over the next eight months.

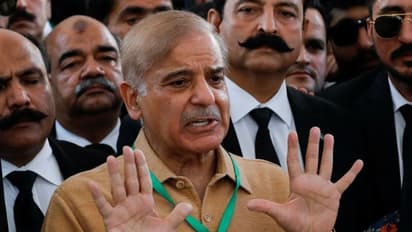

A media report said on Sunday that the Shehbaz Sharif administration is also toying with the idea of seeking a fresh Chinese loan to repay the maturing bilateral debt in 2022-23.

According to the Express Tribune newspaper, Finance Minister Mohammad Ishaq Dar met the Chinese Ambassador to Pakistan, Nong Rong, on Saturday to discuss the rollover and refinancing of nearly $6.3 billion in commercial loans and the central bank debt.

Government officials said that from now till June 2023, Chinese commercial loans worth $3.3 billion and safe deposit loans worth $3 billion will mature. The safe deposit is on the central bank's balance sheet.

Besides this, the bilateral Chinese debt was ballooning to over $900 million during the current fiscal year.

For the current fiscal year, Pakistan's finance ministry and the International Monetary Fund estimated the country's gross external financing requirements in the range of $32-34 billion. However, this does not include the impact of the recent devastating floods, which claimed over 1,700 lives and displaced over 30 million people and caused an estimated loss of over $30 billion to the economy.

During the July-September quarter, Pakistan has already obtained $2.2 billion in loans. Saudi Arabia has announced to rollover $3 billion debt maturing in December 2022. The country still needs to arrange $29 billion.

Islamabad is looking for a minimum of $6.3 billion to $7.2 billion rollover from China and some sort of fresh lending. Citing sources, the paper said that this time the government was seeking rollover of the $3 billion safe deposit for more than a year -- ideally for up to five years.

China has extended a total of $4 billion in safe deposits, of which $1 billion has already been rolled over in July 2022.

On November 1, Prime Minister Shehbaz Sharif is visiting Beijing with a long list of new projects and requests to rollover the existing debt and preferential trade treatment for certain exportable goods. The cash-strapped nation is under pressure from western institutions and the governments to seek a rollover of Chinese debt, currently standing at $26.7 billion, including public and publicly guaranteed debt.

Chinese commercial loans cannot be rolled over but can be refinanced. In order to refinance a loan, the government needs to first pay the maturing debt and then get it back. This not only consumes significant time but also puts pressure on the foreign exchange reserves until the transaction is not reversed.

China had taken three months to refinance a $2.3 billion commercial loan that Pakistan paid back in March. Pakistan's gross foreign exchange reserves currently stand at $7.5 billion.

A finance ministry, in a statement, said that the minister appreciated the Chinese leadership's support for flood relief and refinancing of syndicate facilities of RMB 15 billion ($2.24 billion) to Pakistan. The statement suggests that the two sides discussed commercial loan refinancing.

Meanwhile, Fitch -- the international credit rating agency -- on Friday downgraded Pakistan to the highly risky debt category on the back of contradictory debt rollover statements given by Pakistani policymakers.

Check the Breaking News Today and Latest News from across India and around the world. Stay updated with the latest World News and global developments from politics to economy and current affairs. Get in-depth coverage of China News, Europe News, Pakistan News, and South Asia News, along with top headlines from the UK and US. Follow expert analysis, international trends, and breaking updates from around the globe. Download the Asianet News Official App from the Android Play Store and iPhone App Store for accurate and timely news updates anytime, anywhere.