Bangladesh Rushes to Seal ‘Secret’ US Trade Deal Before Elections Amid India-US Tariff Pact

Synopsis

Bangladesh is rapidly pursuing a trade agreement with the US, driven by a recent India-U.S. pact that lowered tariffs on Indian exports. This has raised concerns for Bangladesh’s vital ready-made garment sector, which fears losing competitiveness.

Bangladesh is moving rapidly to conclude a trade agreement with the United States just ahead of its national elections, in a move widely seen as a response to India’s recently concluded trade pact with Washington that reduced tariffs on Indian exports.

The deal between Dhaka and Washington, reportedly set to be signed on February 9, 2026, has been characterised by secrecy over its terms, raising questions over transparency, economic risks and political timing.

The agreement comes at a critical moment. Just days earlier, India and the United States reached a bilateral trade understanding under which reciprocal tariffs on Indian goods entering the US were cut sharply from around 50% down to 18%, significantly improving the competitiveness of Indian exports in a major global market. Observers say the tariff shift has raised pressure on neighbouring Bangladesh — one of the world’s largest exporters of readymade garments — to secure similar concessions so it can remain competitive.

Bangladesh’s economy is heavily dependent on the ready-made garment (RMG) sector, which accounts for roughly 90% of its exports to the US and employs an estimated 4 to 5 million workers, mostly women. This sector also contributes a sizeable portion of national export earnings and nearly 20% of GDP. Concern over losing market share to Indian manufacturers, whose goods may become significantly cheaper due to tariff reductions, appears to be a key driver behind Dhaka’s urgency to finalise its deal with the US

Why the Deal Is Being Called “Secret”

Unlike most trade agreements, the Bangladesh–US pact has been shrouded in confidentiality. Dhaka reportedly signed a Non-Disclosure Agreement (NDA) with the US government in mid-2025, agreeing to keep details of tariff negotiations and other terms under wraps. Critics say this means that neither the public, parliament nor key business stakeholders have access to the details of the deal, provoking concern and confusion among industry players.

This secrecy has drawn sharp criticism from opposition figures and economists in Bangladesh, who argue that an agreement of such economic import should be debated publicly and ratified by an elected government rather than an interim administration. This criticism is compounded by the fact that the deal is being signed just three days before national elections on February 12, 2026, and will be implemented by the incoming government.

Economic Stakes for Bangladesh

Bangladesh’s export structure makes it particularly sensitive to changes in global tariff regimes. The RMG industry, which forms the backbone of the economy, faces intense competition from India and other Asian exporters.

With India’s new tariff advantage under the US deal, Bangladeshi garment producers may lose price competitiveness — potentially shifting US buyer orders towards Indian suppliers. Economic analysts warn this could have long-term repercussions for Bangladesh’s export growth and employment in the garment hubs of Dhaka, Chittagong and beyond.

Even before the most recent deal, Bangladesh had been negotiating lower tariffs with the US In 2025, Dhaka agreed with Washington to reduce tariffs on its exports from a steep 37% down to around 20%, in a move its leaders described as a diplomatic success. However, with Indian tariffs now set even lower at 18%, Bangladeshi exporters face renewed pressure to secure an improved rate — potentially around 15% — to remain price competitive in the US market.

Industry leaders, including senior figures from the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), have expressed frustration over the timing and opacity of the trade negotiations. Many argue that the deal should have waited until after the elections, allowing elected representatives and business stakeholders to engage in informed debate and protect national economic interests.

Political and Governance Concerns

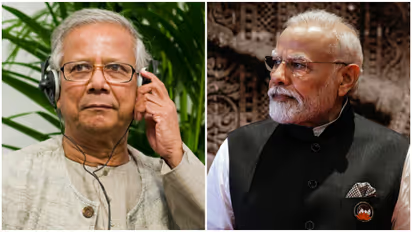

The timing of the deal has sparked controversy beyond economic circles. Bangladesh is currently governed by an interim administration, led by Chief Adviser Muhammad Yunus, after the ouster of former Prime Minister Sheikh Hasina amid widespread protests in 2024. Critics have questioned the legitimacy of such an important trade agreement being signed by a non-elected government so close to polls. There are fears that successive governments could inherit obligations they neither negotiated nor endorsed in public.

Moreover, because NDA terms restrict public access to deal documents, there is limited scrutiny of potential non-tariff conditions that may accompany tariff cuts. Reports from Bangladeshi media and analysts suggest the deal may contain provisions related to importing U.S. agricultural products, machinery, vehicles and even military equipment with reduced barriers, further complicating Bangladesh’s trade policy autonomy.

Some economists argue that while tariff reductions can be beneficial in opening market access, the lack of transparency and absence of stakeholder engagement mean that key sectors could be adversely affected if sensitive products are liberalised without policy safeguards. There are also concerns that stringent conditions imposed by the US could touch on regulatory standards, export certifications and customs procedures that could add compliance costs for Bangladeshi exporters.

Regional Trade Dynamics and Competitive Pressure

Bangladesh’s rush to sign this deal comes in the broader context of shifting global trade dynamics in South Asia. India’s trade diplomacy has been particularly active — including recent agreements with both the United States and the European Union — aimed at reducing global tariff barriers and integrating Indian manufacturers more deeply into international supply chains. Bangladesh, on the other hand, is seeking ways to protect and enhance its competitive edge in key export markets amid these shifts.

Some analysts note that Bangladesh may have benefited previously from relatively favourable tariff rates compared to regional peers. For instance, after its 2025 negotiations with the US, Dhaka secured a tariff rate comparable to those received by countries like Vietnam and Sri Lanka, preserving some level of competitiveness for its garment exports. But with India’s new tariff reduction undercutting the region again, pressure is on Dhaka to respond accordingly.

Business Community Reactions

Bangladesh’s business community is divided. Some industry groups see potential benefits in securing lower tariffs that could sustain market share, while others are worried that the rushed, opaque nature of the agreement could lead to unforeseen obligations and reduced autonomy over trade policy. Exporters fear that they may not have adequate clarity on which products will benefit and which may face new competitive challenges under the terms of the secret deal.

Conclusion: A Critical Inflection Point

Bangladesh’s effort to finalise a trade pact with the United States just days before national elections highlights the intense competitive pressures faced by export-dependent economies in a rapidly changing global trade environment.

While securing lower tariffs may help maintain access to the world’s largest consumer market, the secrecy and timing of the agreement have raised questions about transparency, economic strategy and political accountability.

As the incoming government prepares to take office, it will inherit a trade deal that could have profound implications for Bangladesh’s economy, especially its vital garment sector, its trade policy autonomy and its broader diplomatic alignments.

(With inputs from agencies)

Check the Breaking News Today and Latest News from across India and around the world. Stay updated with the latest World News and global developments from politics to economy and current affairs. Get in-depth coverage of China News, Europe News, Pakistan News, and South Asia News, along with top headlines from the UK and US. Follow expert analysis, international trends, and breaking updates from around the globe. Download the Asianet News Official App from the Android Play Store and iPhone App Store for accurate and timely news updates anytime, anywhere.