Zscaler Analyst Cautious Ahead Of Q1 Results Amid Muted Cybersecurity Industry Trends: Retail Downbeat

Synopsis

Cyber security companies’ near-term trends are mixed but lean toward a “more cautious” outlook, with commentaries pointing to large deal delays.

Cybersecurity player Zscaler, Inc. ($ZS) is scheduled to announce its fiscal-year 2025 first-quarter results after the market closes on Monday, and retail sentiment remained sour in the run-up to the event.

The San Jose, California-based company is widely expected to report non-GAAP earnings per share (EPS) of $0.63, lower than the year-ago’s $0..67 and the previous quarter’s $0.88.

Analysts, on average, expect revenue of $605.52 million compared to the $496.7 million and the $592.9 million, respectively, reported for the year-ago and the previous quarters.

The guidance issued in early August calls for non-GAAP EPS of $0.62-0.62 and revenue of $604 million-$606 million

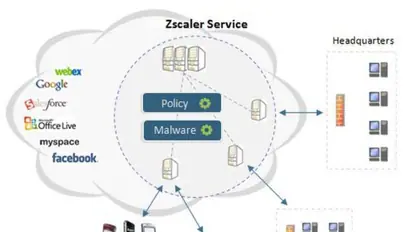

In the preceding quarter, the company’s calculated billings grew 27% year-over-year (YoY) and deferred revenue was up 32%. The company said in August that its cloud platform surpassed over half a Trillion transactions daily. "I'm excited about the year ahead, as we enter Fiscal 2025 with a strong go-to-market machine and a high pace of innovation," CEO Jay Chaudhry had said then.

Zscaler currently expects full-year non-GAAP EPS of $2.81-$2.87 and revenue of $2.60 billion-$2.62 billion.

Most Wall Street analysts raised their price targets for the stock ahead of the company’s quarterly results, according to the Fly. Jefferies analysts hiked the price target from $225 to $245, while maintaining a “Buy” rating. The analysts said the company can meet its conservative first-quarter YoY billings growth guidance of 10%.

Raising the price target from $205 to $238, BTIG analyst Gray Powell said channel checks showed the security space’s performance down-ticking sequentially. Cyber security companies’ near-term trends are mixed but lean toward a “more cautious” outlook, with commentaries pointing to large deal delays, he said.

Partners continue to see a stable competitive environment in large enterprise secure service edge deals and generally view Zscaler as a mid 20's grower for the next year, BTIG said.

Zscaler shares ended Wednesday’s session down 2.54% at $204.96, with the year-to-date returns at a negative 7.49%

Earlier this week, peer CrowdStrike, Inc. ($CRWD) reported better-than-expected quarterly results and raised its full-year guidance, and yet the stock retreated sharply.

On the Stocktwits platform, sentiment toward Zscaler stock was ‘bearish’ ahead of its earnings print.

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.