Lennar, Taylor Morrison Among Builders Reportedly Working On 'Trump Homes' Plan For About A Million Units: LEN, TMHC Stocks Rise

Synopsis

According to a Bloomberg report, the proposal aims to encourage home builders to construct homes under a plan that would allow people to transition from renting to owning.

- The report stated that the plan would allow tenants to have their monthly rent count toward a down payment if they decide to buy the home.

- The plan would take effect after three years of renting.

- The program’s target of one million homes would translate into roughly $250 billion in housing construction, the report said.

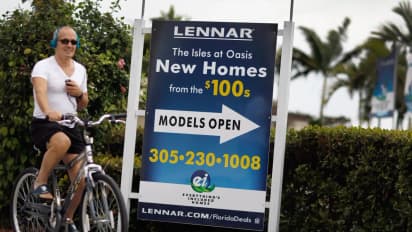

Lennar Corp. (LEN) and Taylor Morrison Home Corp. (TMHC) are among the companies working on a plan to build about one million units under the “Trump Home” initiative.

According to a Bloomberg report citing people familiar with the matter, the proposal aims to encourage home builders to construct homes under a plan that would allow people to move from renting to owning.

Lennar shares were up nearly 6% in Tuesday morning’s trade, while Taylor Morrison shares were up around 5%. Retail sentiment on Stocktwits around Lennar trended in the ‘bearish’ territory at the time of writing.

Plan To Take Effect After Three Years Of Renting

The report stated that the plan would allow tenants to have their monthly rent count toward a down payment if they decide to buy the home. The plan would take effect after three years of renting.

The program would use a rent-to-own business model, with an option to purchase the asset at some point during the agreement. Tenants would continue making rent payments under the agreed terms, with the option to purchase the property after three years of renting under the program.

The program’s target of one million homes would translate into roughly $250 billion worth of housing construction, the report said.

In a post-earnings conference call in December, Lennar CEO Stuart Miller stated that the company is well placed to capitalize on demand for affordable homes. “We’re very well positioned to provide the affordable supply that the market needs when demand is ultimately activated by either lower interest rates or government-sponsored programs to enable affordability,” Miller said.

This comes at a time when President Donald Trump has spoken out about housing affordability.

In a Truth Social post in January, the President announced that he is instructing his representatives to buy up to $200 billion in mortgage bonds. He said this is because Fannie Mae and Freddie Mac have $200 billion in cash, resulting from his decision not to sell them during his first term.

“This will drive Mortgage Rates DOWN, monthly payments DOWN, and make the cost of owning a home more affordable. It is one of my many steps in restoring Affordability,” he said.

Trump Slams Institutional Home Buying

In another post on Truth Social in January, President Trump criticized institutional home-buying, saying that the American dream of homeownership was out of reach for “far too many” people, especially young people.

“I am immediately taking steps to ban large institutional investors from buying more single-family homes, and I will be calling on Congress to codify it. People live in homes, not corporations,” he said.

LEN stock is up 11% year-to-date, while TMHC stock is up 10%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.