IonQ Stock Swings Amid Bullish Analyst Calls As Retail Investors Eye Quantum Computing’s Short-Term Challenges

Synopsis

According to Boston Consultancy Group, quantum computing promises a market opportunity of $90 billion to $170 billion for hardware and software providers by 2040.

IonQ, Inc. ($IONQ) shares saw volatility on Thursday after a couple of analysts issued bullish recommendations.

DA Davidson analyst Alex Platt initiated the quantum computing play with a ‘Buy’ rating and a $50 price target, suggesting scope for a 33% upside from current levels, TheFly reported.

The stock also received a price target boost from Benchmark, which upped the price target from $20 to $50 while maintaining a ‘Buy’ rating, Investing.com reported.

DA Davidson attributed its optimism regarding IoQ to its view that the company represents a “compelling pure-play investment positioned to capitalize on quantum computing’s rapid growth as classical computing proves inadequate to solve complex problems.”

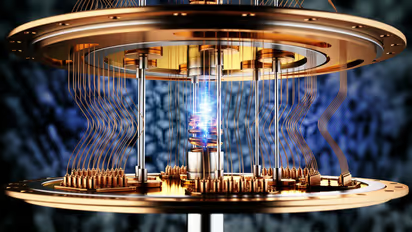

The brokerage said IonQ is a leader in the emergent frontier. Unlike competing architectures from International Business Machines Corp. ($IBM) and Alphabet, Inc. ($GOOGL) ($GOOG) and others, a core technological advantage in IonQ’s trapped-ion qubit architecture offers it greater reliability, accuracy and scalability, it added.

College Park, Maryland-based IonQ manufactures high-performance quantum computers capable of solving complex commercial and research use cases. Its latest quantum computer IonQ Forte boasts 36 algorithmic qubits.

On Thursday, IonQ announced that it was included in the “Newsweek Excellence 1000 Index.” “This recognition is a tremendous honor and a testament to our commitment to not only growing as a company but doing so in responsible, ethical, and sustainable ways,” said Peter Chapman, President and CEO of IonQ.

On Stocktwits, sentiment toward IonQ deteriorated from ‘neutral’ a day ago to ‘bearish’ (44/100) but retail chatter continued to be brisk, with the message volume at ‘high’ levels.

A retail watcher on the platform said the rally could be over, predicting a move below $33.

Another said his bearish outlook is due to the massive losses quantum computing companies in general and IonQ have accumulated.

Quantum computing is widely seen as a long-term opportunity. Jean-Francois Bobier, a partner and vice president at Boston Consulting Group, said, “While there are clear scientific and commercial problems for which quantum solutions will one far surpass the classical alternative, it has yet to demonstrate this advantage at scale.”

“Nonetheless, the momentum is undeniable.”

The consultancy firm estimates that quantum computing will create $450 billion to $850 billion of economic value globally. It promises a market opportunity of $90 billion to $170 billion for hardware and software providers by 2040.

At last check, IonQ stock was down 2.37% at $36.61 after advancing 203% this year. The stock traded in a $36.54-$42.39 range for the day.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.