China Probably Won't Need Nvidia For Long — Beijing's Homegrown AI Chip Empire Is Rising Stealthily

Synopsis

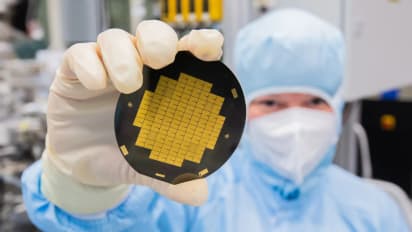

With U.S.–China tensions high and advanced tech at the center, China has ramped up its self-reliance push — and its chip sector has logged solid growth.

- The Chinese semiconductor industry, which includes manufacturers such as SMIC and designers such as Huawei and Cambricon, has built significant in-house capabilities.

- Frustrated by U.S. restrictions on the export of advanced Nvidia chips and ASML’s chip-making machinery, China is pushing for self-reliance as its advanced tech becomes the flashpoint of its geopolitical tensions.

- Stocks of several Chinese chip firms are on a tear.

Chinese tech giant Baidu, Inc. is planning to list its $3 billion chip arm, Kunlunxin, on the Hong Kong Stock Exchange, in what comes as another signal of China’s growing clout in the semiconductor space.

In a strained year for U.S.–China ties, with high-end tech emerging as the main flashpoint, China has intensified its push for self-reliance – and its chip industry has delivered solid domestic gains. Baidu’s IPO plan for Kunlunxin is only the latest example.

Kunlunxin began as an internal Baidu project focused on intelligent chips and launched its first product, the XPU, in 2017. The business was spun off as an independent company in 2021 and has come to the attention of analysts recently. Baidu currently holds a 60% stake in the company and aims to file the IPO papers in the first quarter next year.

China’s Building Capacity

In a sense, China has come from behind this year to challenge the U.S.’s might in advanced technologies, including artificial intelligence and semiconductors.

DeepSeek stunned observers by producing a benchmark AI model at a fraction of the cost of Western ones, while Alibaba and Baidu have been scaling their Qwen and Ernie offerings, respectively, at a breakneck pace.

In the tech equipment space, the U.S. sanctions have been wide and damaging. Over the years, it has blacklisted Huawei and Chinese chipmakers, including SMIC, restricted the export of advanced Nvidia chips, and even ordered the Netherlands’ ASML not to supply lithography machines, used to make advanced chips.

However, with government support and rising demand for AI applications, the Chinese industry is burgeoning, as market trends and product rollouts show.

Chip Challengers

Cambricon Technologies – the Chinese chip designer seen as a challenger to Nvidia – and Huawei are steadily filling the gap left by Nvidia’s forced exit. Cambricon’s shares have climbed about 175% since July, and the company recently vowed to triple its AI chip production next year.

Earlier this year, Huawei stunned the market with its Ascend 910C AI chip, which reportedly matches Nvidia’s A100 in performance and approaches the H100 in specific inference tasks. It now plans to double the output of its most advanced AI chips over the next year.

Meanwhile, chipmaker Moore Threads surged by more than 400% on its Friday debut, while the IPOs of peers MetaX Integrated Circuits and Beijing Onmicro Electronics have received strong bids.

All in all, major players in China’s semiconductor scene – foundries like SMIC and Hua Hong; chip designers HiSilicon (Huawei) and UNISOC; memory chip producers YMTC and CXMT, and equipment makers like NAURA Technology Group and AMEC – are pushing through in a big way.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.