UPI now most preferred payment mode, beats cash transactions: Report

Synopsis

UPI has emerged as the most preferred transaction mode in India, accounting for 57% and surpassing cash, a government survey found. The report cites ease of use and instant fund transfers as primary reasons for its widespread adoption.

Unified Payments Interface (UPI) has emerged as the most preferred mode of transaction, accounting for 57 per cent, surpassing cash transactions at 38 per cent, primarily due to ease of use and instant fund transfer capability, according to a survey.

Government Report on Digital Payment Incentives

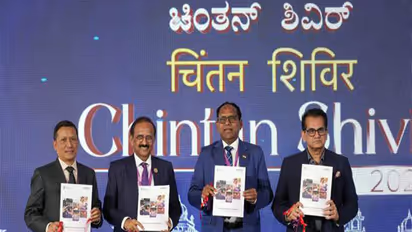

The Department of Financial Services (DFS), Ministry of Finance, released a report titled 'Socio-Economic Impact Analysis of the Incentive Scheme for Promotion of RuPay Debit Card and low-value BHIM-UPI (Person-to-Merchant) transactions' during the Chintan Shivir held last week.

The study has been carried out by an independent third-party research agency in consultation with the National Payments Corporation of India (NPCI). The analysis evaluates the effectiveness of the Government's incentive framework in promoting digital payments, strengthening payment infrastructure, and advancing financial inclusion across the country.

The Incentive Scheme was conceptualised as part of the Government of India's broader policy objective of accelerating universal adoption of digital payments, reducing dependence on cash, and formalising routine economic activity, a release said. Introduced in FY 2021-22 and continued through FY 2024-25, the scheme provided structured budgetary support to acquiring banks and ecosystem participants to ensure that digital payments remained affordable, accessible, and sustainable for citizens and merchants alike.

Survey Methodology

The socio-economic impact analysis is based on an extensive primary survey covering 10,378 respondents across 15 states, including 6,167 users, 2,199 merchants, and 2,012 service providers, representing the key stakeholders of India's digital payments ecosystem along with in-depth secondary research. The study adopted a comprehensive sampling framework spanning five geographical zones- North, South, East, West, and North-East- covering urban and semi-urban locations. Fieldwork was conducted between July 22 and August 25, 2025 using face-to-face Computer Assisted Personal Interviews (CAPI) to ensure accuracy, reliability, and high-quality data collection.

Key Survey Findings

Among other findings in the survey, digital payments now dominate everyday transaction behaviour with 65 per cent of UPI users reporting multiple digital transactions per day. Preference for UPI is particularly pronounced among younger users in the 18-25 age group, where adoption stands at 66 per cent%, indicating strong behavioural shift toward digital-first financial habits.

The study also finds that 90 per cent of users reported increased confidence in digital payments after using UPI and RuPay cards, accompanied by a marked decline in cash usage and ATM withdrawals. Cashback incentives were identified as a key motivation for adoption by 52 per cent of users, while 74 per cent cited speed of payment as the primary advantage.

Merchant Adoption and Satisfaction

Among merchants, digital acceptance has reached near universality, with 94 per cent small merchants reporting adoption of UPI. About 72 per cent expressed satisfaction with digital payments, citing faster transactions, improved record-keeping, and operational convenience, while 57 per cent reported an increase in sales following digital adoption.

Scheme's Impact on Digital Ecosystem

The report highlights that incentives have played a critical role in reducing cost barriers for merchants and acquiring banks, accelerating merchant onboarding, and building trust in digital payment systems across income groups and geographies. Coordinated efforts of the Government, NPCI, banks, fintech players, and payment service providers have collectively strengthened India's digital payments ecosystem and advanced the vision of a less-cash, digitally empowered economy.

Significant expansion in digital payments and infrastructure has been observed during the implementation period of the scheme. Digital transactions increased nearly 11 times, with UPI's share in total digital transactions surging to 80 per cent. UPI QR deployment also expanded dramatically from 9.3 crore to 65.8 crore, enabling widespread merchant acceptance.

The Government's budgetary support of Rs 8,276 crore for the scheme has been significant, with incentive disbursements of Rs 1,389 crore in FY 2021-22, Rs 2,210 crore in FY 2022-23, Rs 3,631 crore in FY 2023-24, and Rs 1,046 crore in FY 2024-25. These disbursements supported banks, payment system operators, and app providers in scaling low-value digital transactions across the country.

The findings of the Socio-Economic Impact Analysis are expected to add value in future policy design and ensure continuity of support for India's digital payments ecosystem. The report reinforces the Government's commitment to building resilient, inclusive, and secure digital public infrastructure that supports economic growth and financial inclusion. (ANI)

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.