SBI's WEF Focus: AI, Cybersecurity, and Sustainable Finance says Setty

Synopsis

SBI Chairman CS Setty at WEF Davos said the lender is focusing on AI, cybersecurity, and sustainable finance. He noted robust domestic credit growth, high digital adoption, and plans to expand the YONO platform, expecting a pause in RBI rate action.

The State Bank of India (SBI) Chairman CS Setty on Wednesday said the lender is increasingly focusing on emerging technologies such as artificial intelligence (AI), strengthening cybersecurity resilience, and sustainable financing, as global economic and geopolitical uncertainties continue to shape discussions at the World Economic Forum (WEF).

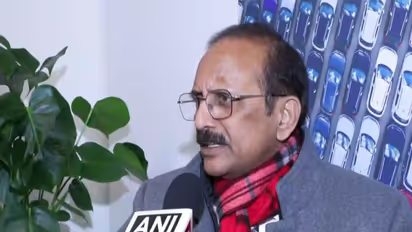

Speaking with ANI on the sidelines of the WEF annual meeting in Davos, Setty said SBI has been participating in the forum for many years and was among the first few Indian banks to do so. "Every year, as the theme changes, SBI also aligns its focus accordingly. For the last two years, I've been coming here," he said.

Setty noted that conversations at Davos have recently centred on AI adoption, cybersecurity in financial services, sustainable finance and decarbonisation, alongside inevitable discussions on geopolitical disruptions.

Domestic Banking and Fiscal Outlook

On the domestic banking scenario, Setty said credit growth remains robust despite concerns around liquidity. Citing Reserve Bank of India (RBI) data for December, he said, "bank credit growth has been in the range of 12-13 per cent, which is in line with nominal GDP growth of around 9-10 per cent. From a nominal GDP point of view, this level of credit growth is normal. Bank credit is robust."

However, deposit growth continues to be an area of focus for the banking sector, he said. "The RBI has ensured adequate liquidity in the system and that discussions with the central bank indicate continued support. Our conversation with RBI indicates that system liquidity will be sufficiently provided for," he said.

Setty also said banks have benefited significantly from recent fiscal measures announced by the Government of India outside the Union Budget, including GST rate cuts and income tax reductions. "The income tax benefit for individuals earning up to Rs 12 lakh has put more money in the hands of households, boosting savings as well as consumption. Consumption credit is picking up," he said.

From a broader fiscal perspective, Setty expressed hope that the government would continue on the path of fiscal consolidation and improved fiscal management.

Digital Transformation and YONO Expansion

On digital transformation, Setty said SBI has seen a massive shift away from branch-based transactions. "Almost 97 per cent of transactions today happen outside the branches through alternate digital channels," he said.

Digital adoption among SBI customers is high, and the bank plans to further scale its digital platform YONO. "Our effort would be to move from a 100 million customer base to 200 million customers on YONO," Setty said, adding that SBI will focus on digital migration while strengthening consumer protection and digital security.

Monetary Policy Outlook

On the monetary policy outlook, Setty said SBI expects a pause in rate action in the near term. "Our house view is that in February, there will be a pause," he said. (ANI)

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.