New CPI to improve monetary, fiscal policy decisions, says CEA

Synopsis

CEA Anantha Nageswaran said the new CPI series, with a revised base year, will improve monetary and fiscal policy decisions by providing an up-to-date basis for assessing incomes, consumption trends, and purchasing power in India's evolving economy.

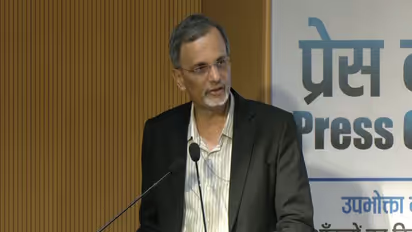

Chief Economic Advisor Anantha Nageswaran on Thursday said that the Consumer Price Index, based on the revised base year, will improve the quality of monetary and fiscal policy decisions.

Talking at an event launching the new CPI series, the CEA said the new series now provides policymakers with a more up-to-date basis for assessing real incomes, consumption trends, and purchasing power.

"It is an important development because it will align us with the best practices that are possible in the world and we may even be going one step ahead of others in the way we will be collating, compiling and presenting key macroeconomic statistics and output and prices going forward," the CEA said.

"The new CPI would help in better distinguishing urban and rural dynamics of inflation at the state level and the subclass/item level as well."

He noted that the economy has undergone a significant transformation over the past decade--consumption behaviour, market structures, and the composition of household expenditure have all evolved.

Policy Implications of New CPI

"The new CPI series therefor,e unsurprisingly reflects these changes," he continued. "What are the policy implications of this? Since the basket is now aligned with recent expenditure data, the inflation signals derived from it will be more closely aligned with prevailing economic conditions. This improves the information basis for calibrating monetary and fiscal policy," he explained.

He also noted that lower weightage on food and beverage items under the new CPI series may make the "headline inflation less volatile."

"Inflation now could become more driven by core rather than food -- and in that sense, policy response -- monetary policy response in particular -- could become more focused on aggregate demand pressures rather than dealing with supply-induced inflation and dealing with it through a demand-sensitive variable like interest rates. Lower volatility could also help anchor inflation expectations in households and businesses," he continued.

New CPI Series with 2024 Base Year

The year-on-year inflation rate based on the All India Consumer Price Index (CPI) for January 2026 is 2.75 per cent higher than in January 2025, with the new base year 2024, according to data released by the Ministry of Statistics and Programme Implementation (MoSPI) on Thursday.

Under the new arrangement, the base year has been revised from 2012 to 2024 using Household Consumption Expenditure Survey 2023-24.

The CPI series with base year 2024 has been introduced to ensure that the index remains representative of current household consumption patterns, price structures, and the evolving nature of the Indian economy, MoSPI said.

Rationale for the Update

The previous CPI series with a 2012 base served as a stable and reliable measure for more than a decade; however, during this period, significant structural changes have occurred in consumption behaviour, income levels, urbanisation, the expansion of the services sector, and digitalisation, it added.

The Ministry of Statistics and Programme Implementation is revising the base year for key macroeconomic indicators--CPI, GDP, and IIP.

In late 2025, the International Monetary Fund (IMF) assigned India a 'C' rating on national accounts, citing outdated data. The base year was perceived to be outdated by the IMF.

Reserve Bank of India (RBI) Governor Sanjay Malhotra had welcomed the base year revision of key economic indicators, noting it will reflect changing consumption patterns, economic structures, and support better-calibrated monetary policy and growth. (ANI)

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.