MPC meeting outcome 2024: RBI keeps Repo Rate unchanged, What does that mean for your home loan EMI

Synopsis

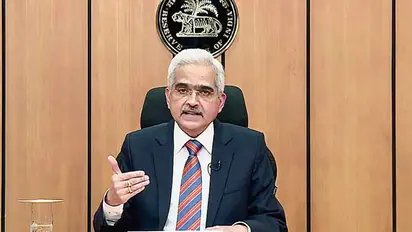

In the announcement, RBI Governor Shaktikanta Das said that the Monetary Policy Committee (MPC) remains vigilant regarding food inflation to ensure that the benefits gained are not eroded.

The Reserve Bank of India (RBI) on Thursday (February 8) opted to keep the repo rates unchanged for the sixth consecutive time, maintaining the rate at 6.5 per cent. The repo rate, which is the interest rate at which RBI lends to other banks, was discussed and decided upon during the three-day meeting of the RBI's monetary policy committee (MPC) held from February 6 to 8.

This decision marks the first bi-monthly policy announcement following the presentation of the Interim Budget 2024 by Finance Minister Nirmala Sitharaman.

Unchanged trajectory: RBI holds Repo Rate steady at 6.50% for sixth consecutive time

In the announcement, RBI Governor Shaktikanta Das said that the Monetary Policy Committee (MPC) remains vigilant regarding food inflation to ensure that the benefits gained are not eroded.

The decision to keep the repo rate steady is a continuation of the rate pause initiated in April 2023. This pause came after a series of six consecutive rate hikes, amounting to 250 basis points, implemented since May 2022.

With the repo rate remaining unchanged, it is expected that there will be no immediate impact on loan EMIs. The decision reflects the intricate balance that the RBI's MPC must maintain between managing inflation and supporting economic growth.

This delicate equilibrium has become particularly crucial amid global uncertainties and challenges, and the MPC has consistently sought to navigate the complexities of the economic landscape.

Explained: Congress Black Paper Vs BJP's White Paper: How different are they?

The RBI conducts these bi-monthly meetings to deliberate and make decisions on key aspects such as interest rates, money supply, inflation outlook, and various macroeconomic indicators, influencing the broader economic climate in the country.

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.