Indian manufacturing ends 2025 strong despite softer growth: HSBC

Synopsis

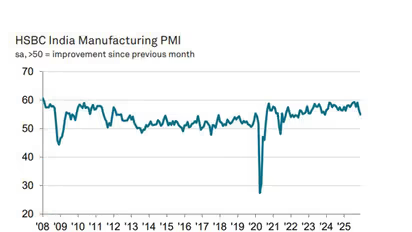

India's manufacturing industry finished 2025 in good shape even as growth momentum eased, says the HSBC India Manufacturing PMI. The index fell to a two-year low of 55.0 in December, with softer expansions in new orders, output, and job creation.

Manufacturing Ends 2025 on a Softer Note

Even with growth momentum easing, India's manufacturing industry wrapped up 2025 in good shape, according to the HSBC India Manufacturing PMI released on Friday. Manufacturers signalled robust, albeit softer, expansions in new orders and output.

The end of the 2025 calendar year was characterised by a loss of growth momentum across several measures tracked by the HSBC India Manufacturing PMI survey. Positive demand trends continued to underpin sharp increases in new business intakes and production, but rates of expansion eased on the back of competitive pressures and subdued sales of specific items.

Inflationary Pressures Ease

Employment rose at the slowest pace in the current 22-month period of job creation, while the latest upturn in buying levels was the least pronounced in two years, according to the PMI report. "As was the case in the previous two months, input costs rose at a historically negligible pace. Concurrently, the rate of charge inflation eased to a nine-month low," it said.

PMI Dips Amid Softer Sales

The seasonally adjusted HSBC India Manufacturing Purchasing Managers' Index (PMI) - a single-figure indicator of sector performance - fell from 56.6 in November to 55.0 in December, signalling the weakest improvement in the health of the sector in two years. The current figure was nevertheless above its long-run average. It noted that part of the slowdown in total sales reflected a softer increase in international orders. New export orders rose to the least extent in 14 months. Where growth was signalled, panellists cited better demand from clients in Asia, Europe and the Middle East.

Impact on Input Purchasing

"A softer increase in new business intakes prompted companies to limit the extent to which inputs were purchased. Buying levels still rose substantially, but the rate of growth retreated to a two-year low," it added.

Job Creation Slows

Amid a general lack of pressure on operating capacities, there was only a marginal increase in factory employment during December. The pace of job creation was the lowest in the current period of growth that began in March 2024.

Expert Analysis and Outlook

Pollyanna De Lima, Economics Associate Director at S&P Global Market Intelligence, said: "Even with growth momentum easing, India's manufacturing industry wrapped up 2025 in good shape. The sharp rise in new business intakes should keep companies busy as we head into the final fiscal quarter, and the lack of major inflationary pressures could continue to support demand."

"We have seen a steady spell of softer growth in new export orders. In fact, the share of companies signalling higher international sales in December was about half of the average for 2025. The survey's anecdotal evidence has also pointed to a narrower range of export destinations, with goods mainly heading to Asia, Europe and the Middle East. With Indian manufacturers facing less intense cost pressures than elsewhere, many will be hoping that competitive pricing can help bring in new business from other regions in the new year." (ANI)

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.