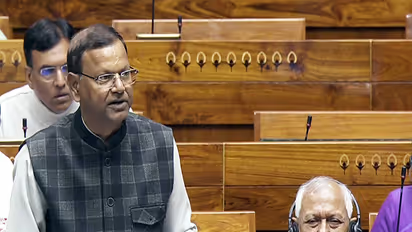

Gross NPA ratio of banks at historic low of 2.15%: Pankaj Chaudhary

Synopsis

The gross NPA ratio of Scheduled Commercial Banks has hit a historic low of 2.15% as of September 2025, declining continuously for eight years, Minister of State for Finance Pankaj Chaudhary informed the Lok Sabha on Monday.

The gross NPA ratio, which is gross NPAs as a percentage of gross loans and advances of Scheduled Commercial Banks (SCBs), for domestic operations, has been continuously declining during the last eight financial years. They were at a historic low of 2.15 per cent as at the end of September 2025 (provisional data), which is lower than 2010-11 level, Minister of State in the Ministry of Finance Pankaj Chaudhary in a written reply to a question in Lok Sabha said on Monday.

Government Initiatives to Tackle NPAs

The Reserve Bank of India (RBI) initiated the Asset Quality Review (AQR) in 2015, post which the Government initiated 4R's strategy of recognising NPAs transparently, resolving and recovering value from stressed accounts through clean and effective laws and processes, recapitalising PSBs, and reforms in banks and financial ecosystem to address the problem of rising NPAs and growing loan default. Enabled by these initiatives, a large drop in gross NPAs was achieved by PSBs, the minister said in his written reply today.

NPA Ratios by Bank Category

RBI has apprised that the data on gross NPAs of SCBs is not collected by RBI on monthly basis. However, as per the latest data available with RBI, as of September 2025, for domestic operations, the gross NPA ratio of SCBs was 2.15 per cent, PSBs was 2.50 per cent, Private Sector Banks (PVBs) was 1.73 per cent and Foreign Banks was 0.80 per cent. Also, PSBs have a higher decline in gross NPA ratio in comparison with the PVBs and Foreign Banks since March, 2018.

Impact on Bank Performance

"This continuous decline in gross NPAs of SCBs, including PSBs, has led to reduced provisioning by them, which in turn has improved their profitability thereby causing positive impact on the business growth. It also indicates that the asset quality as well as underwriting has improved in PSBs supported by a strong balance sheet and sustained profitability," the minister said.

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.