Intuitive Machines expects to raise net proceeds of $104.25 million from the offering and private placement.

Intuitive Machines, Inc. ($LUNR) shares are poised to open at a one-week low on Wednesday after the space exploration, infrastructure and services company announced the pricing of its upsized common stock offering.

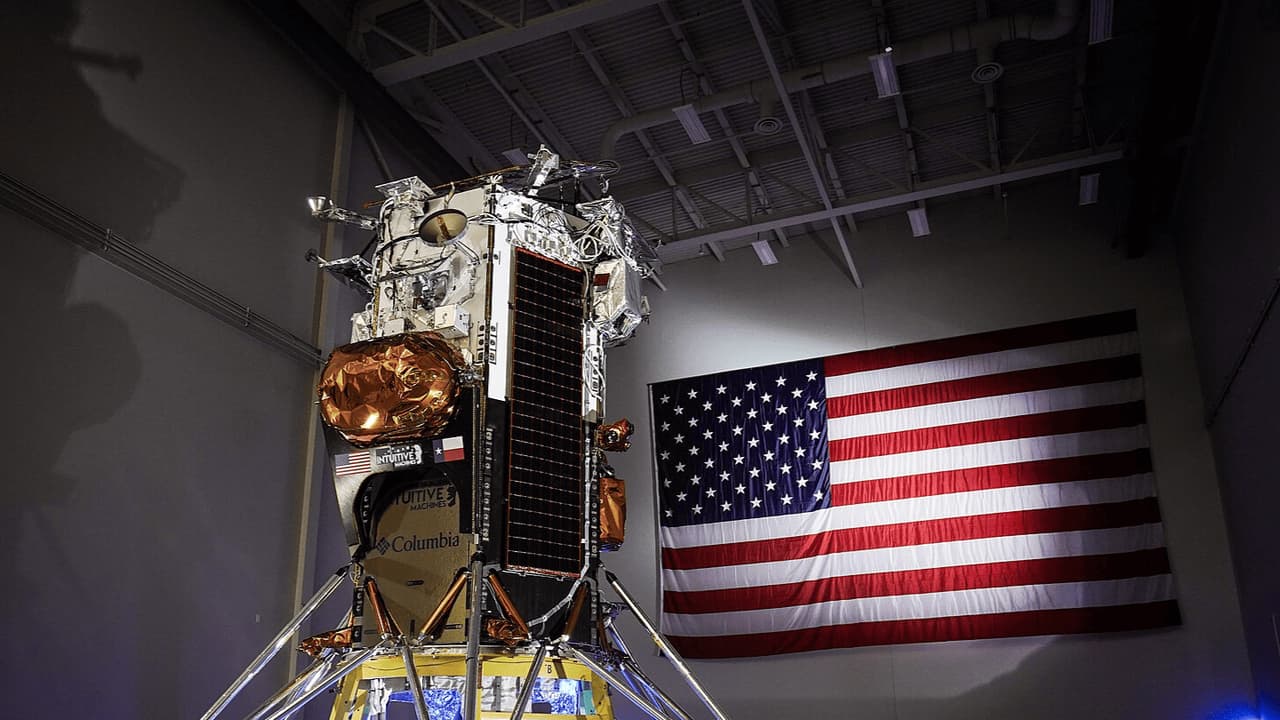

Houston, Texas-based Intuitive Machines said late Tuesday that it priced its upsized offering of 9.52 million Class A common shares at $10.50 per share, a discount to the $14.15 price at which the stock closed Tuesday.

The company quantified the size of the offering at $110 million, up from the $73.9 million it announced earlier, which assumes underwriters exercise the option to buy additional shares.

The offering is expected to close on Dec. 5.

Concurrently, the company announced a private placement of 952,381 shares of its Class A common stock with accredited investor Boryung Corp.

Intuitive Machines expects to raise net proceeds of $104.25 million from the offering and private placement.

The company intends to use the net proceeds to buy new common units of Intuitive Machines LLC from Intuitive Machines OpCo. Intuitive Machines OpCo will, in turn, use the fund for general corporate purposes, including operations, R&D, and potential mergers and acquisitions.

Intuitive Machines shares have traded in a $2.09 to $17.14 range over the past year. The stock has gained over 450% this year, hitting an all-time high of $17.14 on Nov. 29.

In premarket trading, as of 9:18 a.m. ET, the stock plunged 18.73% to $11.47.

On Stocktwits, retail kept its faith in the stock, with sentiment showing an ‘extremely bullish’ mood (76/100), an improvement from the ‘neutral’ disposition that prevailed a day ago. Message volume rose to ‘high’ levels.

Stocktwits users began speculating about massive news coming, given the capital raise, and predicted the stock would hit $100 over the next two to three years.

Another commented that they would buy the dip as the weakness won’t last long.

For updates and corrections email newsroom[at]stocktwits[dot]com.