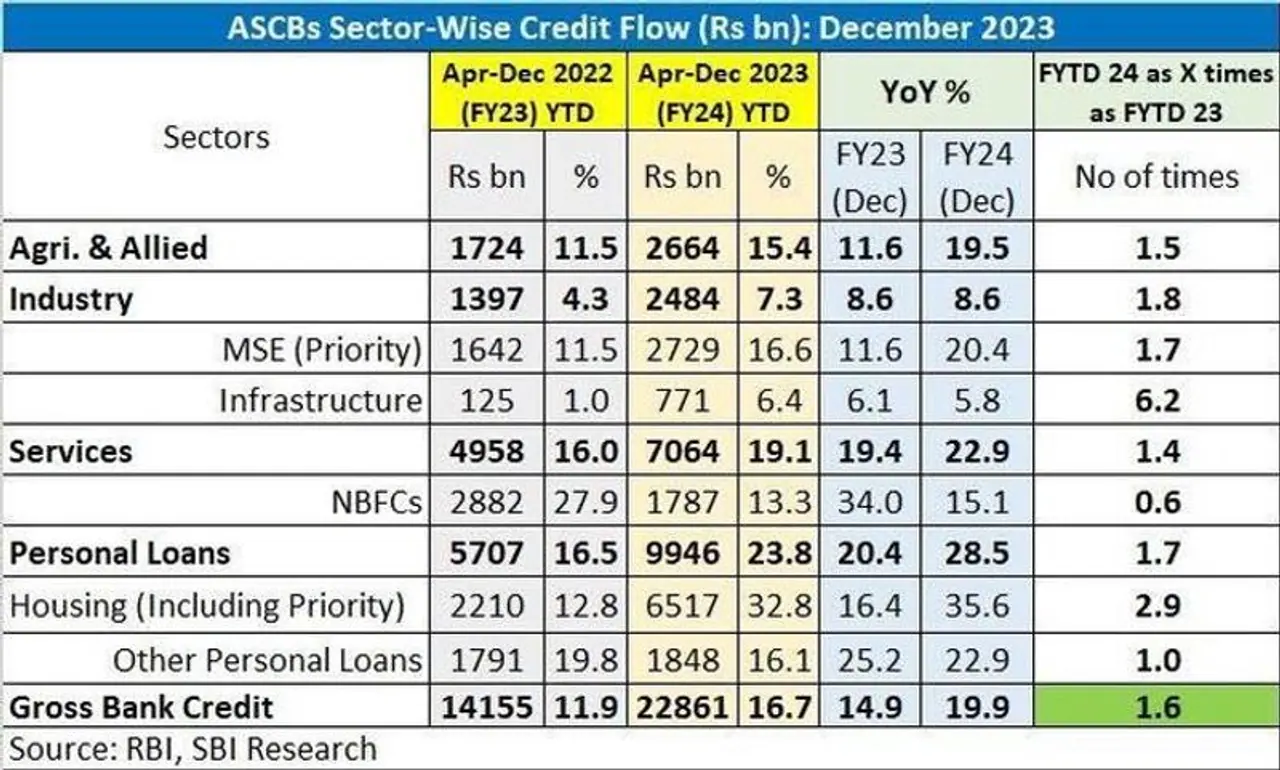

BC Bhartia and Praveen Khandelwal, National President and Secretary General of the Confederation of All India Traders (CAIT), respectively, have expressed their approval of the interim budget. They pointed out that the record-high capital expenditure of 11.1 lakh crore will bring significant benefits to the country's markets, particularly favoring traders. The duo underscored the positive impact on trade operations through the establishment of logistics corridors and enhanced railway cargo handling, which will contribute to the growth of businesses nationwide.

Bhartia and Khandelwal emphasized that the substantial allocation of 11.1 lakh crore will drive various projects, generating increased business opportunities and a notable upswing in employment on a large scale. They conveyed optimism about this expenditure accelerating development, fostering growth in both production and services, thereby making a substantial contribution to the overall progress of the nation.

The CAIT leaders further elaborated that these funds will fuel extensive construction activities, paving the way for the development of new foundational facilities across various sectors. This investment in infrastructure is anticipated to fortify the foundation, leading to improved business conditions and an enhanced production capacity.