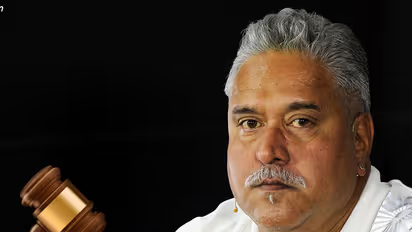

ED attaches Mallya's properties worth Rs 1411 crores

Synopsis

The Enforcement Directorate (ED) has attached properties worth over Rs 1,411 owned by liquor baron Vijay Mallya in a 950 crore loan default case, said a report in NDTV and the Times of India. The investigative agency had registered a case against the business tycoon in March, for defaulting on repayment of a loan taken from IDBI bank in 2009 to pump into his now defunct Kingfisher Airlines.

This is a day after ED moved a Mumbai court to declare Mallya a proclaimed offender. Sources in the Enforcement Directorate told NDTV that among the properties attached were UB Towers in Bangalore and a 27 acre coffee plantation in Coorg. Remaining properties attached are from Mumbai and Chennai. The agency said the properties attached were valued around Rs 900 crore in 2009.

Mallya, reportedly in London, left the country in March as banks attempted to recover around Rs 9,000 crores loaned to his collapsed Kingfisher Airlines. Since then, he has not joined the probe despite repeated summons. Ex-member of Parliament in the Rajya Sabha, Mallya's passport was cancelled in April. ED has also requested Interpol to issue an international arrest warrant against Mallya.

ED has also attached an account with Rs 34 crore bank balance in Laxmi Vilas Bank. The funds have been deposited in the name of a shell company whose ownership is not clear, officials said. The company's director gets a few thousand rupees salary and the ED believes that Mallya controls the company. Similarly, the coffee plantation land and a farmhouse in Coorg are allegedly owned by a Mallya-controlled shell company. The ED has calculated the value of these properties according to the ready-reckoner rate fixed by the government.

Officials said the attachment is provisional and the adjudicating authority will pass an order after hearing Mallya. If confirmed, the ED will explore auction options. As of now, the ED is focusing on attachment of properties in connection with only the IDBI case.

The ED has registered a case against Mallya under the Prevention of Money Laundering Act in the Rs 900-crore default case. The officials said the Rs 864-crore loan was sanctioned to Kingfisher Airlines against the collateral security of the Kingfisher brand, corporate guarantee of UBHL and personal guarantee of Mallya. The bank did not carry out due diligence before disbursing the loan, they added.

Mallya has also defaulted on payment to other banks. He needs to pay Rs 9,400 crore to the SBI-led consortium of 17 banks. The foreign ministry revoked his diplomatic passport on ED's request after he left for the UK in March.