Union Budget 2026: High-Level Banking Committee, NBFC targets for Viksit Bharat

Synopsis

The Union Budget 2026 introduces major financial reforms for the Viksit Bharat 2047 vision. A high-level committee will review the banking system’s structure, governance, and efficiency.

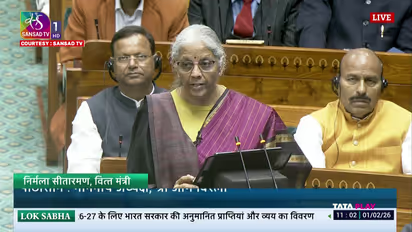

In the Union Budget 2026 presented on February 1, 2026, Finance Minister Nirmala Sitharaman outlined major reforms for India’s banking and financial sector, positioning it as a foundation for future economic growth under the Viksit Bharat 2047 vision.

At the core of her announcements was the proposal to set up a high‑level committee on banking tasked with undertaking a comprehensive review of the entire banking system. This panel will evaluate the structural strength of banks, examine governance standards, and recommend measures to enhance operational efficiency, financial stability, consumer protection, and inclusion as the economy enters its next phase.

The Finance Minister highlighted the improved health of the Indian banking sector — pointing to stronger balance sheets, record profitability, robust asset quality, and wide coverage — as a solid base for further reforms.

A central focus of the budgetary vision was the repositioning of non‑banking financial companies (NBFCs). Sitharaman delineated a clear roadmap for NBFCs with targeted goals for credit growth and technology adoption. To achieve scale and greater efficiency among public sector NBFCs, she proposed restructuring them into larger entities by integrating them with Power Finance Corporation and Rural Electrification Corporation.

These initiatives are designed to bolster credit delivery across underserved sectors, enhance the role of technology in financial intermediation, and align both banking and NBFC segments with India’s broader growth and stability objectives.

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.