South Korea's shipbuilding industry to reclaim 20% global market share

Synopsis

South Korea is on track to reclaim a 20% global shipbuilding market share this year. Despite a global decline in new orders, Korean firms are outperforming rivals like China, partly due to US pressure on Beijing's maritime industry.

South Korea is on track to win back a 20 per cent share of the world's shipbuilding orders this year. This recovery comes as global demand for new ships declines and the United States takes steps to slow China's maritime power.

Market Share and Performance Data

Korea accounted for a 22 per cent share of the global market from January to November, according to a report by The Korea Herald. Data from Clarkson Research shows that Korean shipbuilders received orders for 10.03 million compensated gross tonnage (CGT) during this period. CGT (Compensated Gross Tonnage) in shipbuilding is a standardised unit used to measure a shipyard's workload and output, accounting for a ship's type and size.

Although Korea's total orders fell 5 per cent compared with last year, the country is outperforming its rivals. China is currently the biggest shipbuilder in the world, but its new orders fell by 47 per cent to 26.64 million CGT in the same period. Last year, Korea's share was 17 per cent, its lowest since 2016. Experts now expect Korea to stay in the 20 per cent range for the whole year.

The global shipbuilding industry is seeing fewer orders overall. Total orders across the world fell by 37 per cent to 44.99 million CGT from January to November.

US Pressure on China Creates Opportunity

Korea's performance is strong because the United States is putting pressure on China. The US plans to charge a fee of about USD 50 per ton on ships built in China that enter U.S. ports. This makes it risky for shipowners to procure from China, making Korean builders a better choice.

Korean Shipbuilding Giants Exceed Targets

Large Korean companies are already meeting their goals. HD Korea Shipbuilding & Offshore Engineering has secured USD 18.16 billion in orders for 129 ships so far. This exceeds its target of USD 18.05 billion. Hanwha Ocean has secured USD 9.83 billion in orders, more than it received all of last year. Samsung Heavy Industries has reached 76 per cent of its USD 9.8 billion target by securing contracts for a range of tankers and carriers.

"Although Korean shipbuilders have witnessed a rise in revenues, primarily driven by orders for high-value ships such as LNG carriers, China still dominates the world's shipbuilding market on price-competitiveness," the report quoted an industry source. "But the US Make American Shipbuilding Great Again or MASGA project, along with Washington's curbs on Beijing, is likely to give Korea a strategic edge in gaining more share in the global shipbuilding market."

Strengthening US-Korea Collaboration

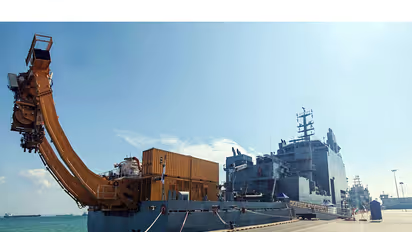

US President Donald Trump recently showed support for working with Korean companies. He announced that Huntington Ingalls and Philly Shipyard would lead the building of new US Navy ships. Hanwha Ocean bought the Philly Shipyard. HD Hyundai and Huntington Ingalls agreed in October to work together on new support ships for the US Navy. This is the first time Korea and the US have collaborated in this way. (ANI)

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.