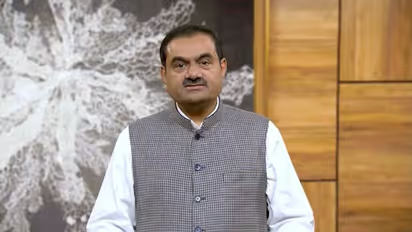

Gautam Adani: Withdrew FPO to insulate investors from potential losses

Synopsis

Gautam Adani said that the decision to withdraw the FPO would not impact either the Group's existing operations or its future plans.

Hours after the Adani Enterprises Limited Board pulled the plug on the Rs 20,000-crore Follow-on Public Offer (FPO), billionaire Gautam Adani reached out to investors on Thursday morning to tell them that the decision to insulate the investors from potential losses.

Adani's statement came amid allegations that Adani Group bought into its own multi-crore FPO.

Also Read: Adani pulls the plug on Rs 20,000 crore FPO, cites investor interest

"After a fully subscribed FPO, yesterday's decision of its withdrawal would have surprised many. But considering the volatility of the market seen yesterday, the board strongly felt that it would not be morally correct to proceed with the FPO," Adani said.

"In my humble journey of over four decades as an entrepreneur, I have been blessed to receive overwhelming support from all stakeholders, particularly the investor community. I need to confess that whatever little I have achieved in life is due to the faith and trust reposed by them. I owe all my success to them. For me, the interest of my investors is paramount and everything is secondary. Hence to insulate the investors from potential losses, we have withdrawn the FPO."

Adani said that the decision to withdraw the FPO would not impact either the Group's existing operations or its future plans.

"The fundamentals of our company are strong. Our balance sheet is healthy, and our assets are robust. Our EBIDTA levels and cash flows have been very strong, and we have an impeccable track record of fulfilling our debt obligations. We will continue to focus on long-term value creation, and growth will be managed by internal accruals. Once the market stabilizes, we will review our capital market strategy," he said.

Thanking the investors, the billionaire said he was humbled and extremely reassured by the support the company received despite the volatility in the stock over the last week.

The announcement to pull the plug came a day after the FPO was subscribed fully on the last day of the offer on Tuesday. As many as 4.62 crore shares were sought as against an offer of 4.55 crore.

According to Bombay Stock Exchange data, non-institutional investors put in bids for over three times the 96.16 lakh shares reserved for them, while the 1.28 crore shares reserved for qualified institutional buyers (QIBs) were almost fully subscribed. However, the response from retail investors and company employees was muted. While employees sought 52 per cent of the 1.6 lakh shares reserved for them, retail investors, for whom 2.29 crore shares had been earmarked, bid for just 11 per cent.

Till late Wednesday, shares of Adani Group firms shed over Rs 7 lakh crore of their combined market capitalisation amid damning charges levelled by US-based short seller Hindenburg Research.

Also Read: L'affaire Hindenburg: Adani Group needs a course correction

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.