The Delhi Police has taken proactive steps to educate the public about the dangers of fake online banking messages. In a social media post, they warned users about fraudsters using Cyrillic script in phishing attacks and shared tips on how to spot fake links.

Government ministries and departments have intensified their efforts to raise awareness among the public in response to the escalating sophistication of scammers and hackers in perpetrating financial fraud. The Delhi Police has taken a proactive step by sharing essential tips aimed at empowering users to identify and avoid fake online banking messages, which pose substantial risks if interacted with.

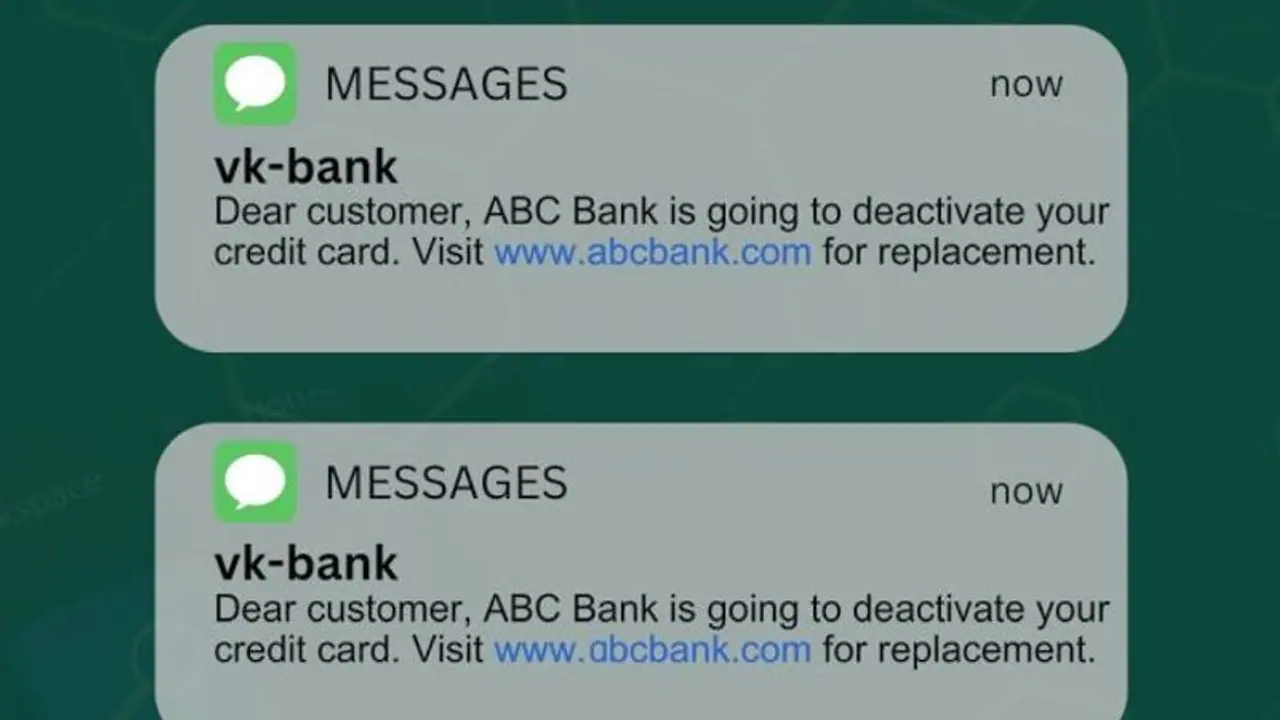

In a post on social media platform X, the Delhi Police underscored the use of Cyrillic script by fraudsters in phishing attacks, urging users to exercise caution and meticulously inspect URLs before clicking on them. They provided detailed explanations and illustrative examples to illustrate how seemingly authentic messages can, in fact, harbour malicious intent.

The use of Cyrillic script presents a significant challenge, as its characters closely resemble those of familiar alphabets used in daily communication. This similarity can be exploited by scammers to create deceptive URLs that mimic legitimate websites. For instance, a seemingly harmless URL such as www.abcbank.com can be easily replicated using Cyrillic characters, potentially leading unsuspecting individuals to fall prey to fraudulent schemes.

Clicking on these counterfeit links can redirect users to meticulously crafted webpages designed to replicate the appearance of genuine bank websites. Once on these pages, users may be prompted to input sensitive personal information such as bank account numbers and passwords under the guise of security measures or account verification processes. Unbeknownst to users, this information is captured by scammers, providing them with unauthorized access to individuals' financial accounts.

Subsequently, scammers may exploit this acquired information to perpetrate various forms of fraud, including unauthorized transactions, identity theft, and financial exploitation. Moreover, in instances where two-factor authentication is employed, scammers may employ sophisticated tactics to impersonate bank representatives and deceive users into divulging additional sensitive information such as one-time passwords (OTPs) or security codes.

To mitigate the risks associated with these fraudulent activities, users are advised to adopt a vigilant approach when encountering messages containing links, particularly those originating from unknown sources or unfamiliar entities. It is essential for users to meticulously scrutinize URLs for any anomalies, including spelling errors or unusual characters, which may indicate potential malicious intent.

Furthermore, users are encouraged to refrain from clicking on suspicious links and instead exercise caution by cross-checking the legitimacy of websites through trusted search engines such as Google. By remaining vigilant and informed, individuals can play an active role in safeguarding their personal and financial information from falling into the hands of fraudsters.