PM Modi in UAE: Prime Minister Narendra Modi congratulated President Sheikh Mohamed bin Zayed Al Nahyan on the launch of UAE’s domestic card JAYWAN, which is based on the digital RuPay credit and debit card stack.

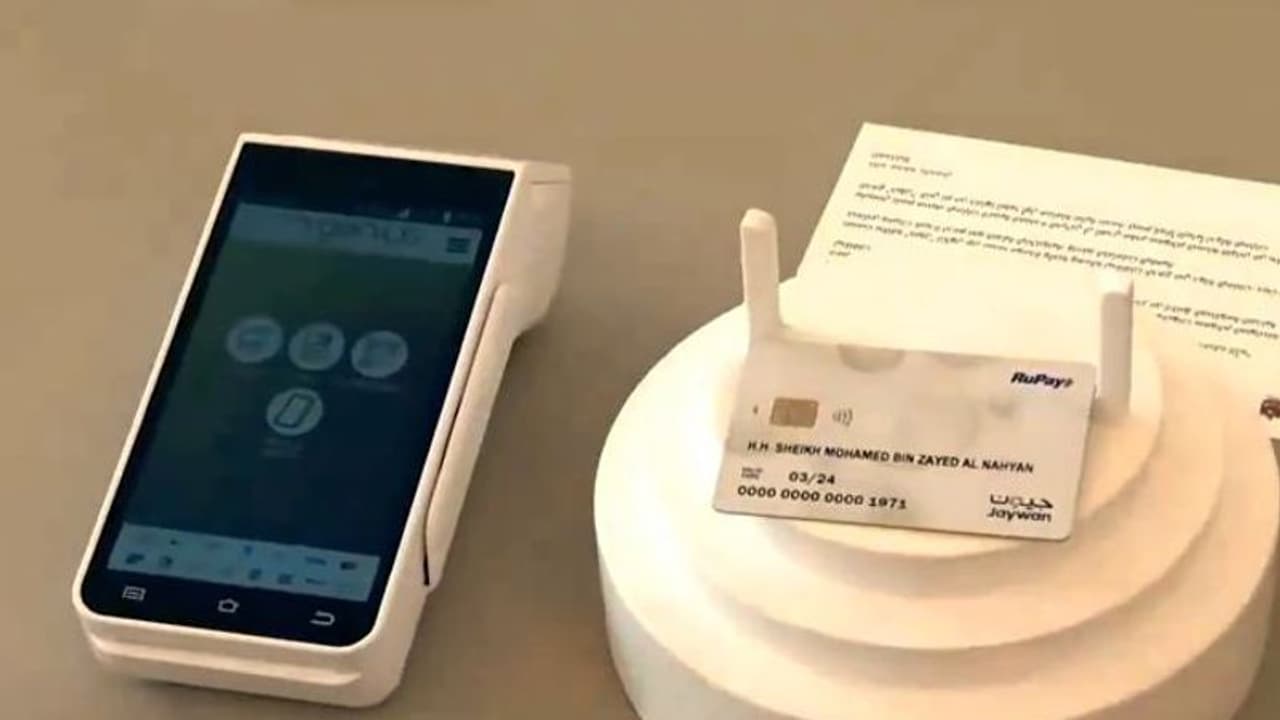

United Arab Emirates President Sheikh Mohammed Bin Zayed Al Nahyan carried out the first transaction based on UAE's domestic card JAYWAN, which is based on the digital RuPay credit and debit card stack, in Abu Dhabi. Prime Minister Modi congratulated President Sheikh Mohamed bin Zayed Al Nahyan on the launch of UAE’s domestic card.

In October 2023, NPCI International Payments Limited (NIPL), a subsidiary of the National Payments Corporation of India (NPCI), entered into a historic agreement with Al Etihad Payments (AEP), an indirect subsidiary of the Central Bank of UAE. This landmark collaboration paved the way for the introduction of the Domestic Card Scheme (DCS) in the UAE, leveraging India's renowned RuPay card network.

The signing ceremony, conducted in Abu Dhabi, witnessed the presence of key dignitaries including Piyush Goyal, Union Minister of Commerce and Industry of India, and Sheikh Hamed bin Zayed Al Nahyan, managing director of Abu Dhabi Investment Authority, signifying a significant milestone in the technological partnership between the two nations.

Under this agreement, NIPL and AEP committed to close collaboration in constructing, deploying, and operationalizing the UAE's national domestic card scheme. The primary objectives included accelerating e-commerce and digital transaction growth, enhancing financial inclusion, and aligning with the UAE's ambitious digitization agenda. Additionally, the partnership aimed to diversify payment options, reduce transaction costs, and bolster the UAE's global competitiveness in the payments industry.

Utilizing RuPay, a secure and widely accepted card payment network indigenous to India, as its foundation, the UAE's DCS aimed to offer debit, credit, and prepaid card options. With over 750 million RuPay cards in circulation, accounting for more than 60% of all cards issued in India, RuPay demonstrated its extensive adoption across public and private sector banks.

India's Digital Public Infrastructure (DPI) framework, consisting of digital identity, digital payments, and digital data exchange layers, played a crucial role in driving fintech innovation within the country. With nearly every adult in India having access to banking services, remote authentication through Aadhar, and affordable mobile internet connectivity, India ranked third globally in fintech ecosystem. Over the past five years, digital transactions in India witnessed a remarkable 367% surge, with an active customer base exceeding 340 million.

The strategic collaboration between NIPL and AEP not only signifies a significant advancement in the UAE's payment systems but also marks a groundbreaking era of technological cooperation between India and the UAE. By leveraging the RuPay card stack and NIPL's expertise, the UAE is poised to transform its payments landscape and embrace a digital future.

The UPI, a real-time payment system, is designed to facilitate inter-bank transactions via mobile phones. Similarly, RuPay, a global card payment network from India, operates akin to Visa or Mastercard, with widespread acceptance at various points of sale, ATMs, and online platforms. The recent launch of RuPay services in the UAE follows closely after the rollout of UPI services and RuPay card services in Sri Lanka and Mauritius. Meanwhile, the UPI payment system continues to gain popularity for retail digital transactions in India. As a mobile-based rapid payment system, UPI enables customers to conduct instant, round-the-clock payments using a virtual payment address (VPA) created by the user.