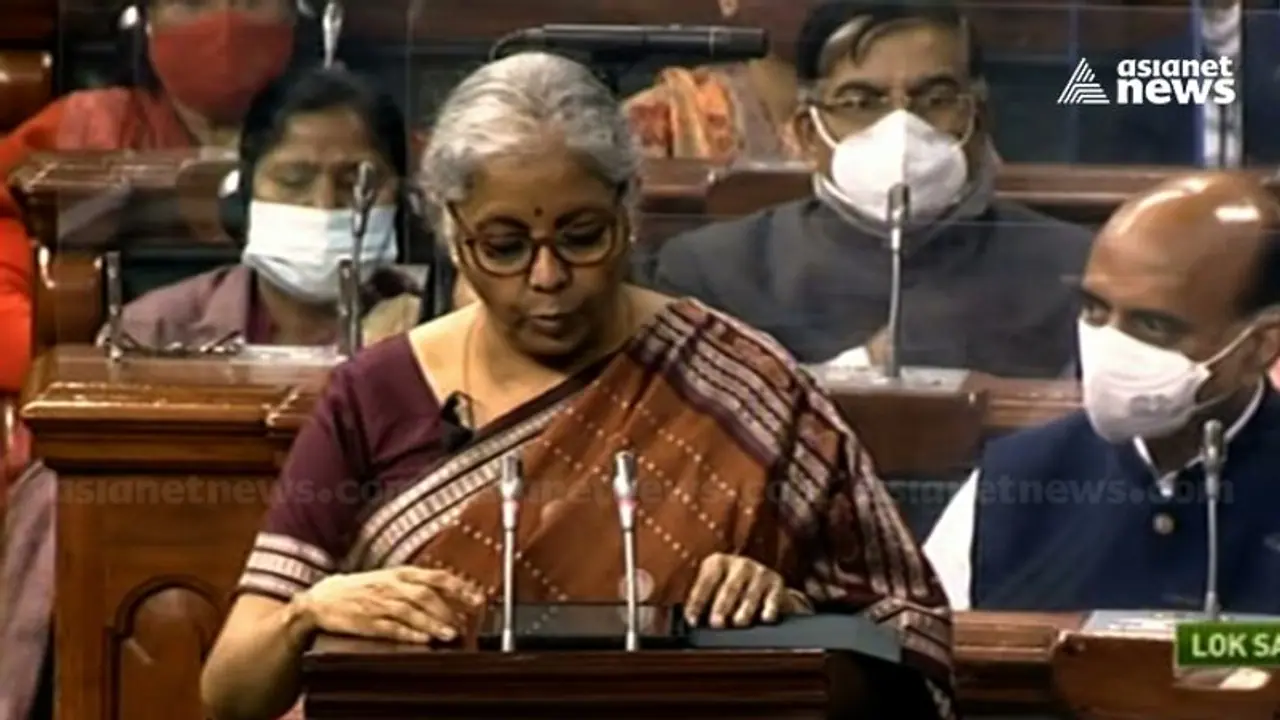

Union Finance Minister Nirmala Sitharaman's Budget 2022 has evoked a range of responses from different sectors.

Union Finance Minister Nirmala Sitharaman's Budget 2022 has evoked a range of responses from different sectors. Let's take a look at some reactions from industry leaders.

'Budget has truly put the spotlight on key issues facing the nation'

Dr Prathap C Reddy,

Chairman, Apollo Hospitals Group

"This year the budget has truly put the spotlight on key issues facing the nation as it emerges from two years of the pandemic. The Union Budget 2022 moves to address the pressing needs with announcements that will act as an emollient not just for the economy but also the people. The budget with its digital push in education and skilling for all shows that it has its heart in the right place."

"During the pandemic, we saw an immense contribution of start-ups to innovation in healthcare and the extension of the tax benefits for another year should encourage more start-ups in the health-tech space to come up and invest in R&D especially in the field of AI-powered smart wearables and predictive healthcare. This will, in turn, be invaluable in strengthening our fight against non-communicable diseases, which can otherwise derail the economic recovery by impacting our productive demographic."

"The budget keeps us on track on enabling universal health accessibility with the proposed National Digital Health Ecosystem. With digital registries of health providers and health facilities, unique health identity for each individual will help in providing universal access to health facilities. Along with the national tele-mental health program, this shows the enhanced focus on health. At Apollo Hospitals, we look forward to contributing to the success of these path-breaking initiatives along with the rest of the private sector healthcare."

'Union Budget has been disappointing for Travel & Tourism'

Madhavan Menon

Managing Director, Thomas Cook (India) Limited

"The Union Budget 2022-23 reflected the development and investment orientation, with much-needed emphasis on infrastructure, technology, skill development and health. From a Travel & Tourism perspective, however, the Union Budget has been disappointing. The Budget made no reference to the industry’s recommendations to aid revival, including rationalization of taxes (a complete GST holiday, exemption of TCS on outbound tours, reduction in indirect taxes), removal of SIES benefit capping of Rs 5 crore".

"For a sector that is a key contributor to the country's GDP and brings invaluable foreign exchange earnings, with a force multiplier impact on employment and skill development, a stimulus would have created significant value in supporting the country’s road to recovery and growth."

"The limited relief in acknowledgement of the severe impact to the hospitality sector, was the extension of the Emergency Credit Line Guarantee Scheme (ECLGS) to March 2023, with an expansion by Rs. 50,000 crores to a total of Rs. 5 lakh crore."

'A pro-growth and forward-looking budget'

Ajay Srinivasan

Chief Executive, Aditya Birla Capital

"The Finance Minister has presented a pro-growth and forward-looking budget. It has complemented macro growth with social welfare while being accommodative on fiscal consolidation. The budget has differentiated itself with its focus on the digital economy, startups, and tech-enabled development as well as energy transition and climate action."

"The Capex-heavy budget has reiterated the focus on public investment to modernize infrastructure over the medium term. The overall focus is clearly to nurture growth and support the economic recovery."

'A Budget with a vision to transform India'

Zarin Daruwala,

Cluster CEO, India and South Asia markets (Bangladesh, Nepal and Sri Lanka)

Standard Chartered Bank

"This is a growth-oriented Budget, with a focus on using available fiscal space, via higher tax buoyancy, towards additional spending. I strongly believe that the focus on capex, the highest in more than 15 years, will have a high multiplier impact and am optimistic that elevated Government spending will spur private sector investments. The budget has supported both the old and new economy in a comprehensive manner, and continued supporting the vulnerable segments of the society and economy."

"The Union Budget 2022-23 is a Budget with a vision to transform India in the medium term. The budget has adopted a new economic growth template for 'Amrit Kaal' (run-up to India@100) by promoting capital expenditure led economic growth. An outlay of Capital expenditure of Rs 7.5 lakh crore, up 35% YoY (and at 2.9% of GDP) along with expanding the scope of private Capex through PLI for new age segments is expected to deliver inclusive growth, job creation and welfare for all."

'We expect economic and capital market buoyancy'

Vijay Chandok

MD & CEO, ICICI Securities

"The Budget also seem to be presented in the backdrop of likely pandemic aftereffect which is reflective in the relatively conservative estimation of growth (merely 11% nominal GDP in FY23) and receipts. Thus, there is a likelihood of a lower than projected fiscal deficit. With growth-oriented focus intact in the Budget, we expect economic and capital market buoyancy to remain."

'Finance Minister has presented a forward-looking budget'

Anuj Mathur

MD and CEO

Canara HSBC OBC Life Insurance

"Overall, the Finance Minister has presented a forward-looking budget with a focus on the next 25 years of long term socio-economic growth of India. Various measures in the sectors of infrastructure, agriculture, MSME development, urban planning, hospitality and digital payments have been proposed."

"For the insurance sector, while there are no direct intervention measures, the overall growth-oriented budget will help all sectors of the economy. The FM in her speech remained focused on the agenda of tax rationalization and simplification instead of giving further tax exemptions, which I believe will have long term benefits."

"Proposal for a substantial increase in capital expenditure is a positive move, which will eventually increase employment and therefore consumption and disposable earning of people resulting in demand for financial saving products. We commend efforts of the Government to focus on spending, which will have a multiplier effect for the economy.”

'Budget gives decent visibility for large sectors'

Rajeev Ratan Srivastava

CEO, Standard Chartered Securities (India) Ltd

"The Union Budget is broadly in-line with the consensus. Higher thrust on capital expenditure is reflected by earmarking Rs 10.7 trillion in 2022-23 as compared to Rs 7.77 trillion in 2021-22. We remain positive on the broader market with better visibility of CY22 investment themes and recent correction (due to FPI sell-off) which has led to valuations becoming reasonable. India stands at strong macro-fundamentals, we expect CY22 to offer decent upside. This budget gives decent visibility for large sectors like BFSI, Capital goods, cement, Infra, etc."

Also Read: Budget 2022: Take a look what gets cheaper and costlier in this budget

Also Read: Budget 2022: FM announces Digital rupee introduction by RBI