GST Council meet: Hostels to platform tickets, here's what will get cheaper

Synopsis

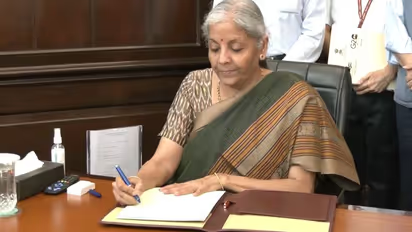

Union Finance Nirmala Sitharaman chaired pre-Budget consultations with finance ministers of states and Union Territories to take their views. It was followed by the 53rd meeting of the GST (Goods and Services Tax) Council.

Many items, including milk cans, student housing, train station tickets, and tax slab rationalisation, will be more affordable after the 53rd meeting of the Goods and Services Tax (GST) Council. These items will either be exempted from taxation or have their tax rates rationalised.

In the 53rd GST Council’s meeting on Saturday, it was decided that hostels and railway platform tickets will be exempted from the GST. Union Finance Minister Nirmala Sitharaman said that while hostels within educational institutions are already exempt from the GST, now hostels outside of the institutions would also be exempted.

Separately, Sitharaman also announced that all milk cans will be universally taxed at 12 per cent. Additionally, decisions about GST rates for shipping containers and customer railway services were made during the meeting.

The services of the railways to the generic public are set to be cheaper as they would be GST exempt.

Among these services are: Platform ticket sales, Retired room, waiting room, and cloak room services available, Car services powered by batteries; and Within-railway exchanges.

In addition, services provided by a special purpose vehicle (SPV) to the railways would not be subject to taxes. A subsidiary established for particular reasons within a parent firm is referred to as an SPV. Companies like Rail Vikas Nigam Limited (RVNL) and RailTel are examples of the railroads' SPVs.

Cartons, boxes, and cases of both corrugated and non-corrugated paper or paper-board will be taxed at 12 per cent instead of previous rate of 18 per cent. All milk cans, whether made of steel, iron, and aluminium, will be uniformly taxed at 12 per cent.

In the pre-Budget meeting, Sitharaman underlined the Centre's support to states through timely tax devolution and GST compensation arrears to boost growth.

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.